The Canadian economy has returned to (or is forecast to) exceed the pre-pandemic levels of major economic indicators by the end of 2021. Nevertheless, Canada’s unemployment rate is forecast to remain above pre-pandemic levels throughout Quarter 1 of 2021. Similarly, economic indicators for BC have returned to or exceeded levels prior to the COVID-19 induced recession for the province. BC’s immunization plan which utilizes the four vaccines currently available for distribution is a driving force of much of this economic growth. As of the end of Q1, more than 10% of BC residents have been vaccinated with their first dose, and it is forecast that by June 2021, everyone 18+ will have their first dose.

Throughout Q1, BC remained under stricter Phase 3 restrictions in response to COVID-19. As mentioned in previous posts, Canada and BC have been offering financial support to aid people and businesses recover from the uncertain economic environment. This article gives readers an update from Q4 2020 to Q1 2021 of selected economic indicators. The indicators discussed herein are both indicative and representative of the Canadian, BC, and regional economies

Labour Market

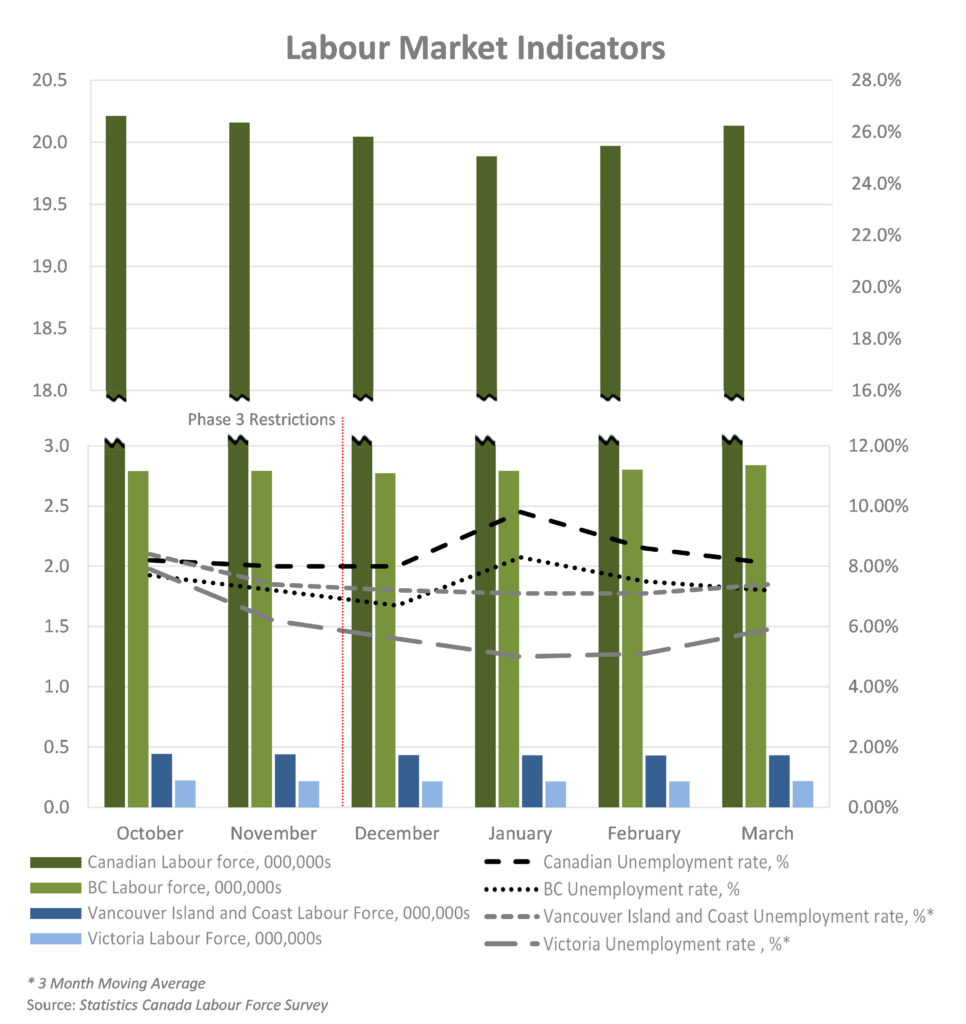

The labour force refers to the supply (employees) and demand (employers) for labour. The number of labour force participants and the unemployment rate are indicators that highlight the material changes that took place in the labour market from Q4 2020 to Q1 2021.

The federal government has initiated a number of programs to support employers and employees impacted by COVID -19. In November, they initiated the Canada Emergency Rent Subsidy (CERS) to help support Canadian businesses, NPO’s or charities cover part of their commercial rent or property expenses due to drop in revenue from the virus. Furthermore, the government has extended the COVID-19 support programs until September 25, 2021; this includes the Canada Recovery Benefit (CRB),the Canada Emergency Wage Subsidy (CEWS), and the Canada Recovery Sickness Benefit (CRSB).

Before the impact of COVID-19, Canada was experiencing a steady increase in labour force participants. As of March 31, 2021, the Canadian labour force consisted of 20.1 million people, an increase of approximately 87,400 participants since December of Q4, 2020 to pre-COVID levels. During Q1 the Canadian unemployment rate ranged between 8.00% and 9.80%. The high of 9.80% took place in January of 2021, when there was an increase in COVID-19 cases following the holidays. At the end of Q1 the unemployment rate was 8.10%, which was 2.20% higher than pre-pandemic rates. While the national unemployment rate has not yet returned to pre-pandemic levels, there is a downward trend as vaccination rates increase slowly.

BC’s unemployment rates have reflected national trends which decreased from 8.30% for the start of Q1 to 7.20% at the end. BC’s Immunization Plan started at the end of Q4 2020 and progressed to Phase 2 during Q1. Mass vaccination of the high-risk population has resulted in many returning to work. In contrast, the unemployment rates for Victoria and the Vancouver Island and Coastal regions increased from 5.00% to 5.90% and from 7.10% to 7.40%, respectively. These rates are significantly higher than the pre-pandemic rates of 3.50% and 5.30%, respectively.

Gross Domestic Product (GDP)

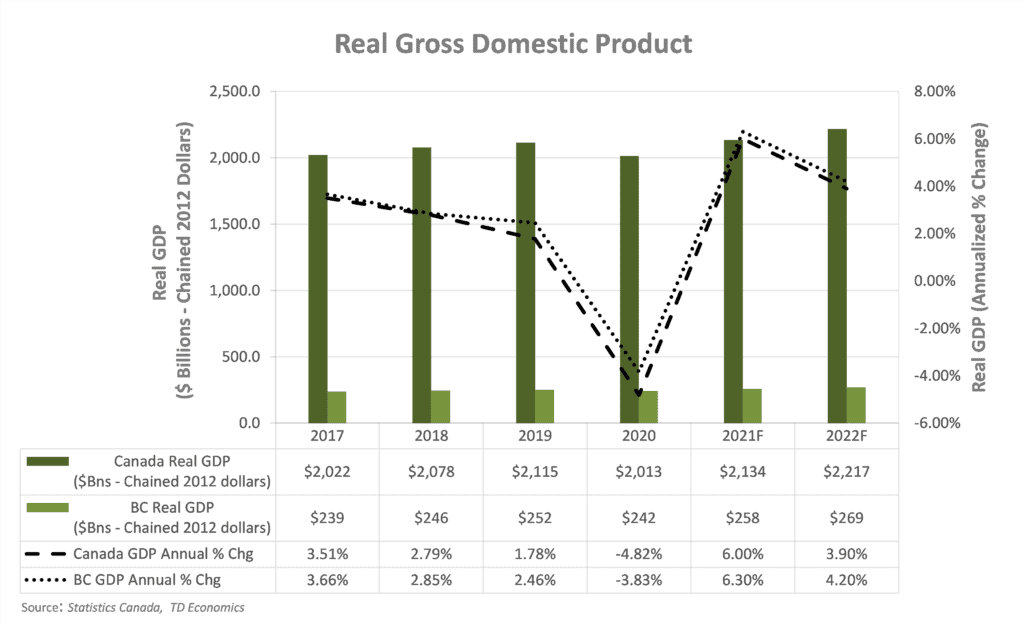

Canada’s real GDP declined by -4.82% over the prior year for 2020 which is slightly better than the -5.60% TD Economics (TDE) forecast from December 2020. TDE forecasts real GDP to grow by 6.00% for 2021 and exceed pre-pandemic levels due to fewer health restrictions and increased vaccinations.

British Columbia’s GDP followed the national trend and declined by -3.83% during 2020, better than TDE’s forecast of -5.30% in December. TDE forecasts an upturn in the economy resulting in a real GDP increase of 6.30% for 2021, which is 1.20% higher than predicted during quarter 4 of 2020 and the resulting forecast GDP of $252 billion would exceed pre-pandemic levels. BC expects to remain under Phase 3 restrictions through to the mid-point of the next quarter when greater vaccine distribution increases.

Housing Market

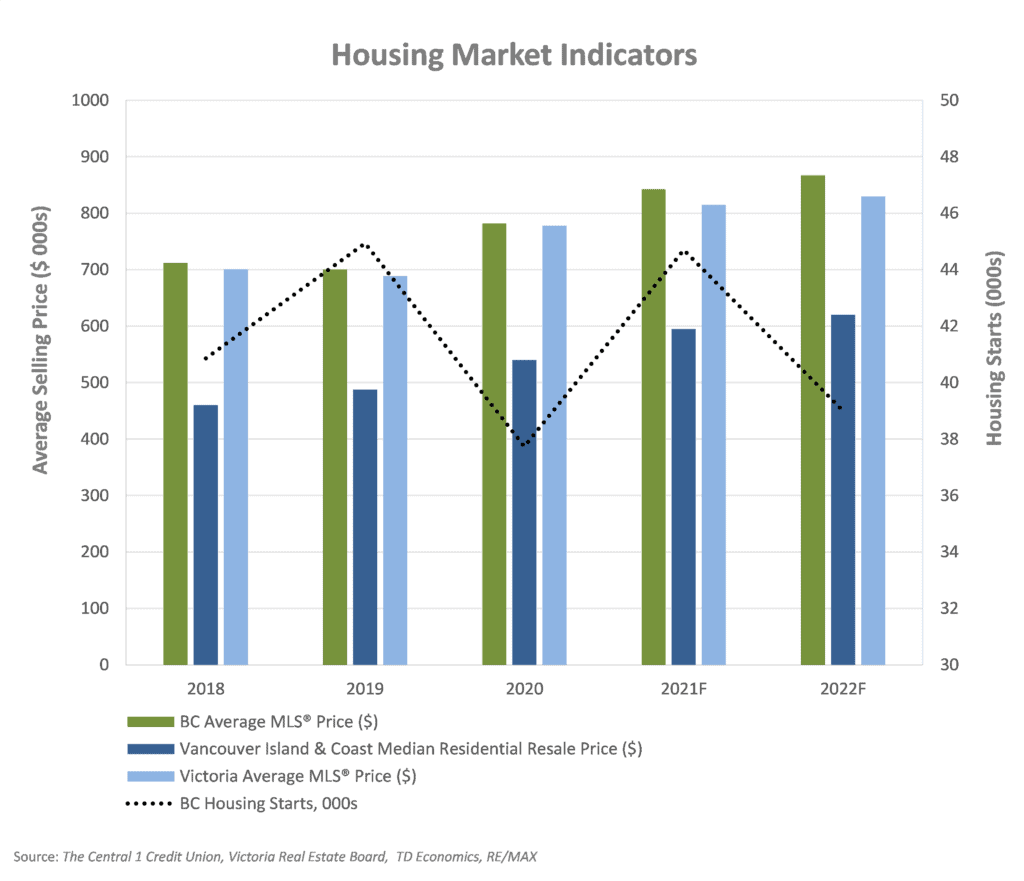

Housing starts and average residential prices reflect market indicators with strong correlation to both the construction and real estate industries. BC’s housing starts dropped by 16.02% from 2019 to 2020. BCREA forecasts an increase of 18.46% for 2021 followed by a decrease of 12.75% for 2022.

The residential average price in BC has increased substantially despite the COVID-19 induced recession. The MLS® Home Price Index was at its highest at the end of Q1. The average MLS® price for BC increased 11.62% from 2019 to 2020 and BCREA forecasts an increase 7.75% for 2021 to an average price of $842,000 and 2.97% for 2022 to an average price of $867,000 for 2022. Average MLS®® prices for Victoria, BC increased by 13.0% from 2019 to 2020 and BCREA forecasts increases of 4.80% and 1.80% for 2021 and 2022, respectively.

Interest Rates & Foreign Exchange

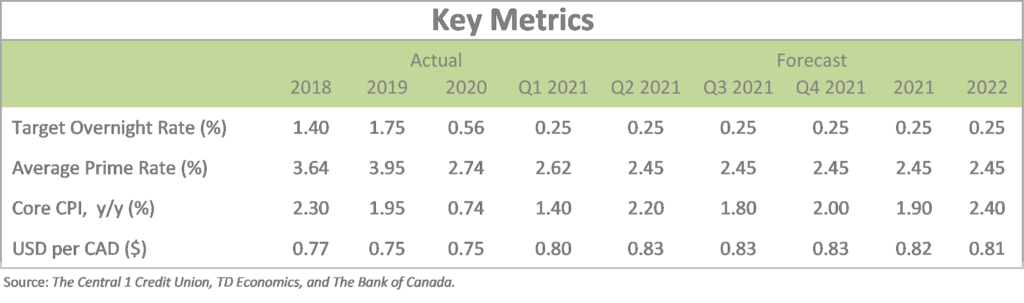

The Bank of Canada (BoC) expects to maintain the overnight target rate at its lower limit of 0.25% until 2023. The last time the target rate was this low was in 2009 following the financial crisis.

The low overnight target rate has led to a significant decrease in the prime rate, so Canadian business owners can obtain lower cost financing and consider refinancing existing debt at lower rates. As a result of the series of rate cuts, the average prime rate was 2.62% for Q1, but reached a low of 2.45% at the end of the quarter. The prime rate is forecast to remain at this level into the beginning of 2022.

Canada’s inflation rate ranged from 0.74% to 2.30% for the four years ended 2020. TDE expects inflation to increase by 1.90% for 2021 and 2.40% for 2022. For 2021, the average annual USD to CAD exchange rate is forecast to increase to $0.80 USD/CAD, an increase from the 2020 rate of $0.75 USD/CAD. TDE Quarterly Economic Forecast forecasts the USD to CAD exchange rate will stay at the $0.80 USD/CAD for 2022.

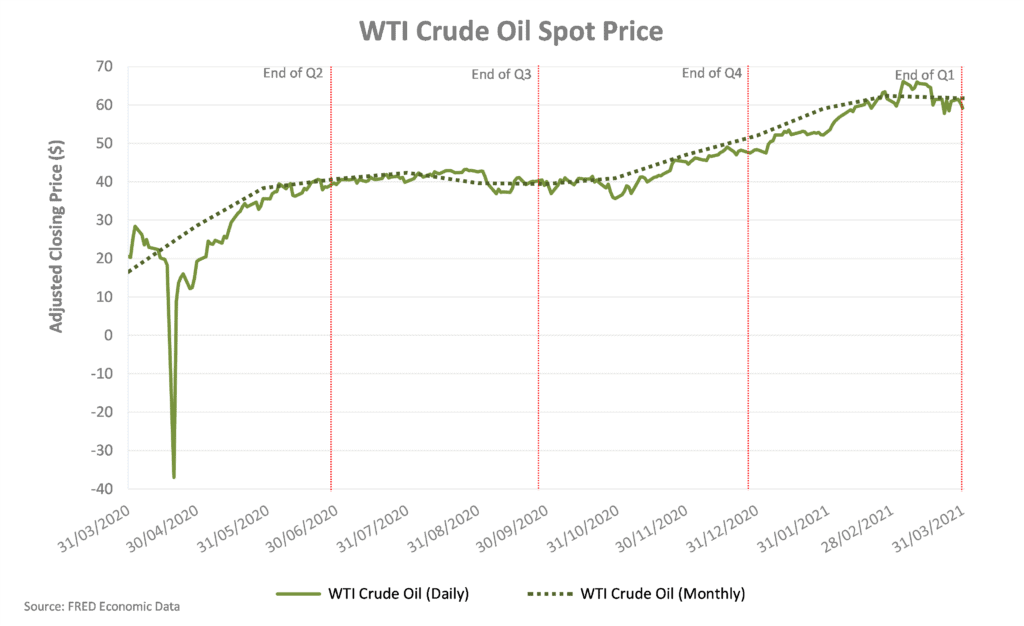

Crude Oil Prices

In 2019, Canada produced 4.7 million barrels per day (MMb/d), imported 0.8 MMb/d, and exported 3.8 MMb/d of crude oil. As a net oil exporter, the Canadian economy is heavily impacted by the price of crude oil with the greatest impact felt in Canada’s major oil producing provinces. The majority of Canadian crude oil production is in Alberta (81.00%), Saskatchewan (10.00%), and Newfoundland and Labrador (6.00%). In North America, the West Texas Intermediate (WTI) crude oil spot price is the benchmark oil price.

Historical WTI crude oil daily spot prices (as of March 31, 2021):

- 20-year average: $62.68

- 10-year average: $67.56

- 5-year average: $52.26

- 3-year average: $53.35

- 2019 annual average: $56.99

- 2020 average: $39.16

- 2021 Q1 average: $58.09

Analysts are cautiously optimistic when it comes to forecasting oil prices. Throughout the year, the oil and gas industry underwent two crises: (a) decreased demand due to COVID-19 and (b) price collapse due to a price war between OPEC and Russia. Both crises have led to oversupply risks across the industry. Over the course of Q1, WTI oil prices saw stable growth from $47.47 to $59.19, with a high of $66.08 on March 5th. This growth can be attributed to the increase in vaccinations and the regulatory approval of AstraZeneca and Johnson & Johnson vaccines. OPEC projects that global oil demand to grow by 5.96 million b/d this year.

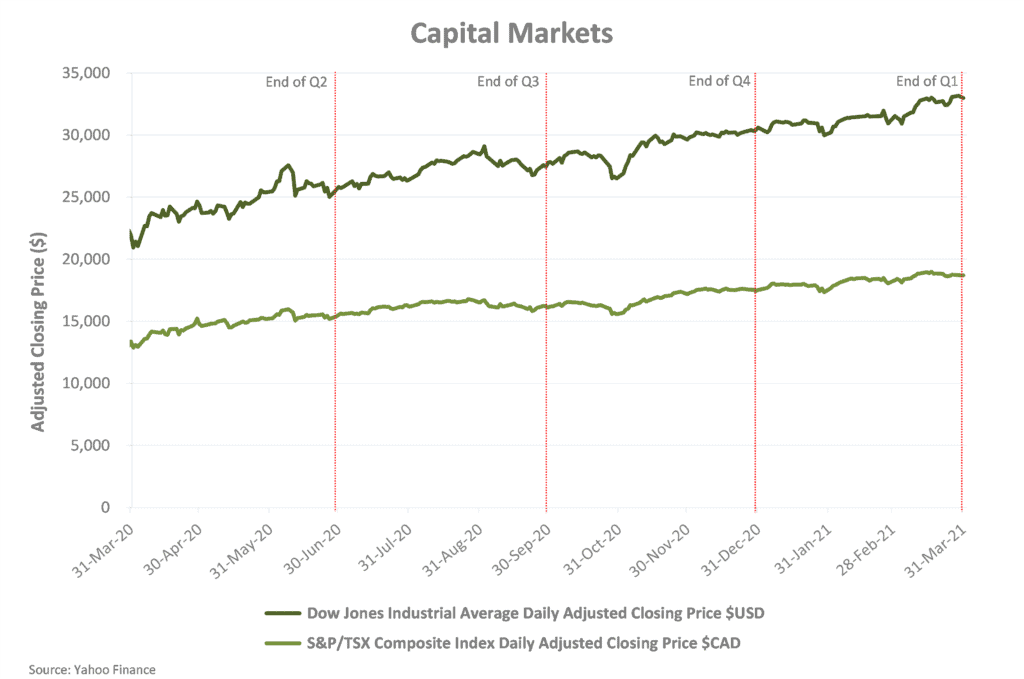

Capital Markets

The international response to COVID-19 at the beginning of March 2020, negatively impacted the current and anticipated operations of many privately-owned and publicly traded North American businesses. For publicly traded companies this impact is evident in changes in capital markets during the period. As of March 31, 2021, the year-to-date percentage gain for the Dow Jones Industrial Average (DJIA) and S&P/TSX Composite index are 7.76% and 6.69%. In Q1 these indices saw a gain of 9.12% and 5.76%. At the end of Q1 of 2021, the DJIA surpassed the all-time high seen in Q4, and is now at 32,982. The S&P/TSX Composite index has continued to increase past pre-pandemic levels and is at 18,701.

Although capital markets have fully recovered, it is important to note that the actions investors are taking are largely optimistic and are based on forward looking assumptions and analysis. As we have covered in the other sections of this report, global and Canadian economies are still struggling to overcome the impact of COVID-19.

Moving into quarter 2 of 2021, BC will be moving into phase 3 of the immunization plan and plans to introduce a new Restart Plan for the BC economy. As of February 9, 2021, Canada had vaccinated 3.00% of their total population while the USA, and the UK are at vaccination rates of 13.50% and 19.70% respectively. It is expected that widespread vaccination in Canada may not be a reality until the middle of 2022, making Canada one of the trailing nations with a goal of widespread vaccination.

Nevertheless, it will be difficult to gauge the full impact of COVID-19 on the Canadian, BC, and regional economies until the world has recovered from the pandemic. The metrics analysed indicate an optimistic outcome, with a current economic forecast making a near recovery by the end of 2021. Business owners will benefit from taking advantage of the fiscal stimulus provided by our governments refinancing their existing debts with the historically low interest rates.

A glossary of all defined terms can be found here.

[1] In 1977, the TSE 300 index was created, comprising of the 300 largest companies on the TSX. In 2002, Standard and Poor’s took responsibility of the index and renamed it the “S&P/TSX Composite Index”.