By mid-2022 of the prior quarter, the Canadian economy had fully returned to or exceeded the pre-pandemic levels of most major economic indicators.

By mid-2022 of the prior quarter, the Canadian economy had fully returned to or exceeded the pre-pandemic levels of most major economic indicators.

In Q3 2023, Canada’s economy contracted from the prior quarter. TD Economics’ (TDE) forecasts GDP growth for Canada of 1.2% for 2023 (0.4% lower than forecast in the prior quarter) and 0.7% in 2024. The Bank of Canada is expected to continue the testing stage of their decrease in the overnight rate during Q2 2023. TDE forecasts an increase in Canada’s unemployment rate from the 5.5% forecast for 2023 to 6.5% for 2024. Overall Canada’s economic outlook remains cautious due to domestic and global factors.

In the prior quarter, BC experienced a disruptive port worker strike and wildfires. Despite these events, TDE notes that BC remains the only province without a downgrade to its 2023 growth forecast. Nevertheless, TDE expects BC’s economy to face a more pronounced downturn in 2024. Housing activity in BC rebounded in early 2023, driven by the Bank of Canada’s decision to pause interest rate hikes. Despite robust retail spending and resilient consumer strength in Q2, BC may experience a slowdown in consumer spending in Q4 given that the province has the country’s highest average debt burden.

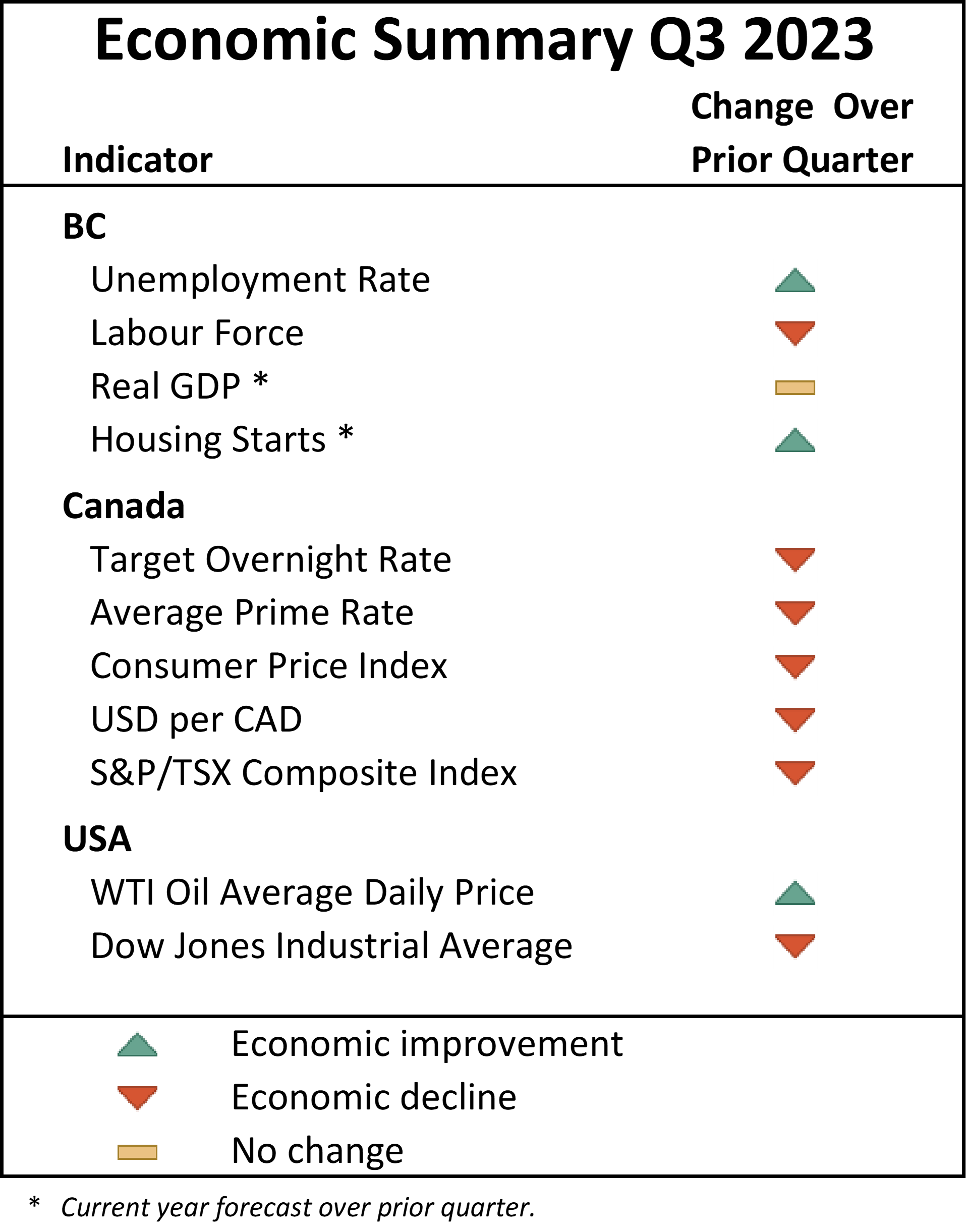

This post provides an update from Q2 2023 to Q3 2023 for selected economic indicators. The indicators discussed herein are both indicative and representative of the Canadian, BC, and regional economies.

Labour Market

The labour force refers to the supply (employees) and demand (employers) for labour. The number of labour force participants and the unemployment rate are indicators that highlight the material changes that took place in the labour market from Q2 2023 to Q3 2023.

COVID-19 Government Programs

The Jobs and Growth Fund no longer includes COVID-19-specific requirements. Instead, it is accessible to assist companies that meet certain criteria in fostering regional job creation and to support the long-term growth of local economies. This includes supporting initiatives such as the adoption of clean technology, sustainable economic growth, underrepresented groups, or the adoption of digital solutions.

National

Before the impact of COVID-19, Canada experienced a steady increase in labour force participants. As of September 30, 2023, the Canadian labor force totaled nearly 21.4 million people. This reflects a reduction of about 250,000 participants compared to the previous quarter but remains higher than the pre-COVID level of 20.0 million.

At the start of Q3, the national unemployment rate stood at 5.2%. This rate increased during the quarter to a high of 6.3% in August 2023 but returned to the initial rate of 5.2% by the end of the quarter. Notably, this figure remains 0.7% lower than the pre-pandemic unemployment rate of 5.9%. Despite this, TDE forecasts a gradual upward trajectory in Canada’s unemployment rate.

BC

During Q3, BC’s unemployment rate decreased from 5.4% to 4.9%, which remains 0.1% lower than the province’s pre-COVID rate of 5.0%. TDE forecasts BC’s average unemployment rate for 2023 to be 5.2%, which is slightly higher than their Q2 forecast of 5.0%. TDE expects BC’s unemployment rate to further increase for 2024 and 2025.

Regional

The unemployment rate for Vancouver Island and Coast regions decreased during Q3 from 4.4% to 4.8%, which is 0.5% lower than the pre-pandemic rate of 5.3%. In Victoria, the unemployment rate showed an upward trend over the prior quarter, rising from 3.6% to 4.3%, which is above its pre-pandemic unemployment rate of 3.5%..

Gross Domestic Product (GDP)

National

TDE forecasts Canada’s real GDP in 2023 to grow by 1.2% which is below their Q2 forecast of 1.6%. This growth is attributed to increased employment in the quarter. This forecast is a significant decline from the 3.7% in real GDP year-over-year growth for 2022 which TDE attributes to strikes and wildfires.

Looking ahead, TDE expects a continued economic slowdown for 2024, but a rebound is foreseen in 2025 and 2026, stabilizing at an annual GDP growth rate of 1.7%. TDE notes that this stability will be due to strong population and labor force growth, although productivity growth is projected to lag. Despite below-trend growth in consumer spending, business investment is predicted to surpass normal levels, driven by increased demand for housing and opportunities in the clean energy sector.

BC

TDE maintains a growth forecast of 1.2% for the BC economy for Q3, consistent with their Q2 2023 forecast and in-line with their national forecast. The July port worker strike and summer wildfires contributed to the TDE forecast but were offset by a surge in housing activity and strength in consumer spending.

The resulting forecast for BC’s GDP is $275.3 billion, surpassing 2022 by $3.3 billion and exceeding the pre-pandemic 2019 GDP by $20.1 billion. While BC’s growth aligns with the national rate of 1.2% this year, TDE forecasts that BC’s growth for 2024 will be 0.2% below the national rate of 0.7%..

Housing Market

BC

Housing starts and average residential prices reflect market indicators with a strong correlation to both the construction and real estate industries. BC’s housing starts decreased by -1.9% during 2022. The BC Real Estate Association (BCREA) forecasts a decrease in housing starts of -1.5% for 2023, followed by another decrease of -12.4% for 2024, due mainly to the slowing economy and recent interest rate increases.

BCREA forecasts a decrease of -2.0% in the BC average MLS® price for single-family dwellings for 2023, resulting in an average price of $976,000 for the year. BCREA forecasts an increase of 2.4% in MLS® price for 2024, resulting in an average price of $1,000,100.

Regional

BCREA forecasts a decrease in average MLS® prices for single-family dwellings on Vancouver Island of -5.6% for 2023, with a subsequent increase of 3.4% forecast for 2024. In Victoria, BCREA forecasts a decrease in the average MLS® prices for single-family dwellings of -2.7% for 2023 and an increase of 3.6% predicted for 2024.

Interest Rates & Foreign Exchange

During Q3 2023, the Bank of Canada (BoC), increased the overnight target rate to 5.00%. TDE predicts that the rate will remain at 5.00% throughout the remainder of 2023 before decreasing to 4.25% for 2024 and decreasing again to 2.50% for 2025.

The rising overnight target rate resulted in an increase in the prime rate. The average prime rate for Q3 was 7.2%, which is an increase of 0.25% from the prior quarter. The prime rate will likely plateau in alignment with the target overnight rate.

The BoC has stated that it will continue to increase policy rates to return the inflation rate to the long-term target of 2.00% from its recent high of 6.80% for 2022. Naturally, there is expected to be some lag in the process, and TDE forecasts inflation to be 3.80% for 2023 before decreasing to 2.80% for 2024, and 2.10% for 2025. The BoC attributes Canada’s inflation decreases to lower energy, durable goods, and some service prices.

TDE forecasts the average annual USD to CAD exchange rate at $0.75 for 2023 and $0.74 for 2024. This exchange rate tends to correlate to oil prices, and over the long-term the value of the Canadian dollar relative to the US dollar typically fluctuates in-step with oil price changes.

Crude Oil Prices

Canada is one of the top 5 largest oil producers. As a net oil exporter, the Canadian economy is heavily affected by the price of crude oil, with the greatest impact felt in Canada’s major oil-producing provinces. The majority of Canadian crude oil production is in Alberta (81.0%), Saskatchewan (10.0%), and Newfoundland and Labrador (6.0%).

In North America, the West Texas Intermediate (WTI) crude oil spot price is the benchmark oil price. Historical WTI crude oil daily spot prices at the end of Q3 were:

Throughout the third quarter, WTI oil prices rose from $69.71 on July 7, 2023, to a peak of $93.67 on September 27, 2023, concluding the quarter at $90.77. The International Energy Agency (IEA) attributes this price surge to resurgent Chinese consumption and increased demand for jet fuel and petrochemical feedstocks. TDE forecasts the WTI crude oil price to average $78.50 per barrel for 2023 and $80.00 for 2024.

Capital Markets

The international response to COVID-19 at the beginning of March 2020 negatively impacted the current and anticipated operations of privately-owned and publicly traded North American businesses. The Dow Jones Industrial Average (DJIA) and S&P/TSX Composite Index witnessed the greatest single-day percentage drop since the stock market crashes of 1943 and 1987, respectively.

By the start of 2021, both indices had recovered to their pre-COVID-19 levels and in the first quarter of 2022, both indices reached all-time highs. In Q3 2023, the DJIA index fluctuated between $33,508 USD (on September 29, 2023) and $35,631 USD (on August 1, 2023). The S&P/TSX, on the other hand, ranged from $19,436 CAD (on September 27, 2023) to $20,626 CAD (on July 31, 2023).

The quarter-over-quarter change was -3.0% for the S&P/TSX and -2.6% for the DJIA. It is important to note that these indicators are based on forward-looking assumptions and analysis.

TDE forecasts that real GDP growth will continue to decrease due to weakening consumer confidence and spending as a result of higher unemployment which will be offset by increased business investment in part due government subsidies for clean energy and infrastructure projects. TDE expects inflation to decrease as the BoC is expected to hold off from additional interest rate hikes as inflation decreases towards their target range of 1% and 3%. As a result, TDE expects a continued slowdown in economic growth for Canada in 2023 and 2024, and a potential rebound in 2025.

Higher input prices and labour costs are expected to continue to stifle profit margins in multiple industries. Nevertheless, energy, commodity, and food-producing sectors could continue to benefit from higher prices. TDE expects interest rates hold steady, maintaining downward pressure on housing prices.