Compared to our previously posted Q1 Economic Update, COVID-19’s impact on the economy has become more apparent. On May 19, BC entered Phase 2 of BC’s Restart Plan, (4 phase plan) entering Phase 3 on June 24. It is anticipated that BC will remain in Phase 3 for the rest of 2020. As mentioned in our previous posts, Canada and BC have been continuously offering fiscal stimulus in order to ease the COVID-19 induced blow. This article gives readers an update from Q1 to Q2 of 2020 of selected economic indicators. The indicators discussed herein are both indicative and representative of the Canadian, BC, and regional economies

Labour Market

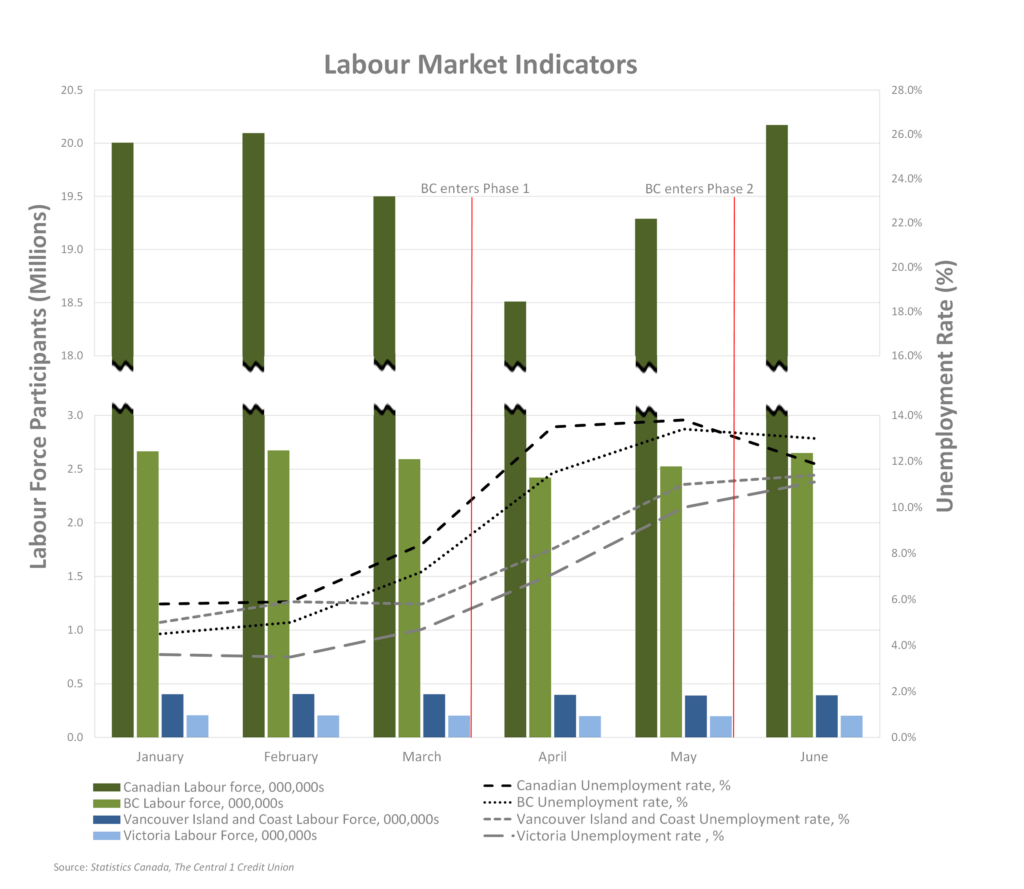

The labour force refers to the supply (employees) and demand (employers) for labour. The number of labour force participants and the unemployment rate are indicators that highlight the material changes that took place in the labour market from Q1 to Q2. Before the impact of COVID-19, Canada was experiencing a steady increase in labour force participants. Those who were temporarily laid off typically expected to return to the same job when the labour market strengthened and were subsequently excluded from the labour force.

The federal government initiated the Canadian Emergency Response Benefit (CERB) as a fiscal stimulus for those who were temporarily out of work, which ended on September 26, 2020. The Canada Emergency Wage Subsidy (CEWS) is another fiscal stimulus initiative introduced by the federal government with the aim of supporting pandemic affected businesses retain their employees. Near the end of Q2 when businesses started re-opening, labour force participants increased as more individuals were seeking work, causing a V-shaped trend.

From Q1 to Q2, Canada and BC’s unemployment rates have increased from 8.4% and 7.2%, to a high of 13.8% and 13.4%, respectively, the highest unemployment rates historically recorded for these regions. Despite having some of the lowest regional unemployment rates in Canada, Victoria and Vancouver Island followed a similar trend with unemployment rates increasing from 4.7% and 5.8% to an all-time high of 11.1% and 11.4%, respectively.

Gross Domestic Product (GDP)

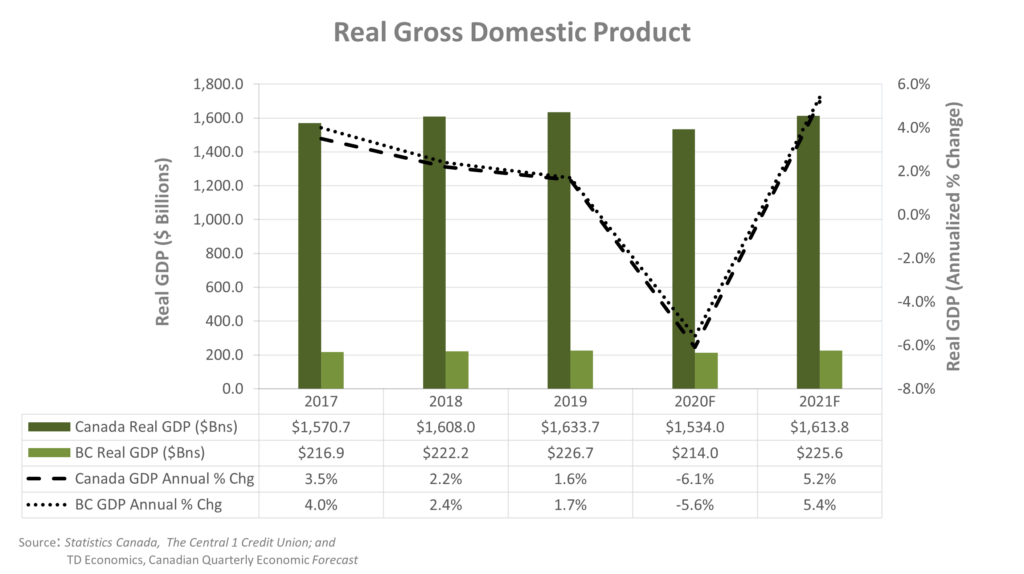

During Q1, TD Economics forecast the country’s GDP to contract by 42.0% in Q2; however, it actually contracted by 36.1%. TD Economics’ current forecast expects Canada’s Q3 GDP to increase by 27.5%. Canada can expect to see an overall 2020 GDP contraction of 6.1% (Q1 forecast: 7.5% contraction) followed by a near complete economic rebound of 5.2% (Q1 forecast: 7.3%) in 2021.

As BC moved into Phase 3, BC’s tourism and accommodation and food service sectors have been able to resume operations with regulated social distancing measures. The capacity constraints faced by these sectors contributed significantly to the Province’s economic contraction. Similar to Canada’s forecast, BC’s 2020 outlook is more optimistic than as previously forecast in our Q1 2020 Economic Update. BC’s GDP is expected to contract by 5.6% (Q1 forecast: 6.0%), with a strong rebound of 5.4% forecast for 2021.

Housing Market

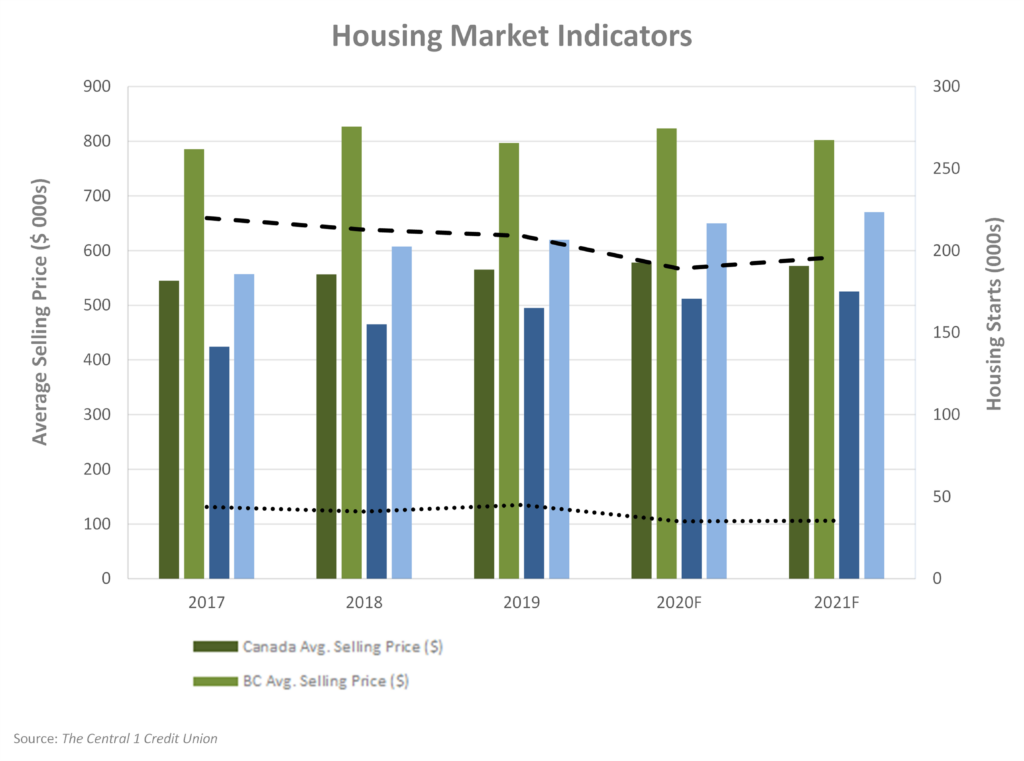

Housing starts and average selling price reflect market indicators with strong a correlation to both the construction and real estate industries. Canadian housing starts are forecast to decrease by 9.6% in 2020 with a rebound of 3.7% in 2021. BC’s housing starts are forecast to drop by 22.0% (Q1 forecast: drop by 29.8%) in 2020 and remain at this level throughout 2021 (Q1 forecast: 31.7%). Sales of residential dwellings in BC declined by 60.0% from February to April of 2020; however, May’s sales were up by 31.0% followed by an astounding 70.6% increase in June.

Recent increases in residential property sales has elevated BC’s current 2020 average home price forecast by 3.3% (Q1 forecast: decline of 3.5%) followed by a decline of 2.6% during 2021. The Vancouver Island and Victoria regions are predicted to increase through 2020 and 2021, demonstrating this region’s continued resilience to external market factors.

Interest Rates & Foreign Exchange

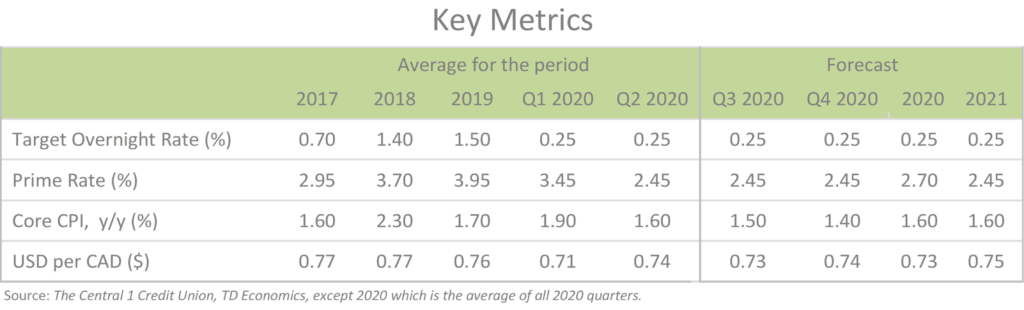

On March 27, following a series of interest rate cuts, the Bank of Canada (BoC) cut the overnight target rate to its lower limit of 0.25%. The last time the target rate was this low was in 2009 following the financial crisis. After the March 27 rate cut, the BoC has hinted that there will be no hikes in interest rates until 2023.

The considerable reduction in the overnight target rate led to a significant decrease of the prime rate, allowing Canadian business owners to obtain lower cost financing and consider refinancing existing debt at lower rates. As a result of the series of rate cuts, the prime rate decreased to 2.45% and is forecast to remain at this level into the beginning of 2022.

Canada’s inflation rate ranged from 1.6% to 2.3% during the three years ended 2019. Due to the nation’s expected GDP contraction for 2020, inflation is now forecast to range between 1.4% and 1.6%, which is lower that the Q1 forecast of 1.8% to 1.9%.

During 2017 and 2019, the annual average USD to CAD exchange rate was consistently between $0.76 and $0.77 USD. Q1 of 2020 presented some challenges for the CAD as it fell to an average of $0.71 USD for the period; however, it regained some strength compared to the USD when it rose to $0.74. The CAD is expected to trade at an annual average of $0.73 USD during 2020 and is forecast to trade at an annual average of $0.75 USD in 2021.

Crude Oil Prices

According to the BDC, “lower oil prices have a direct negative impact on Canada’s oil producing provinces and trickle-down impacts in the rest of the country.” The majority of Canadian crude oil (96%) is produced in Alberta (81%), Saskatchewan (10%), and Newfoundland and Labrador (6%). In North America, the West Texas Intermediate (WTI) crude oil spot price is used as the benchmark oil price.

Historical WTI spot oil prices (as of June 30, 2020):

- 20-year average: $61.86

- 10-year average: $70.38

- 5-year average: $51.43

- 3-year average: $55.12

- 2019 annual average: $56.98

On April 20, 2020, the WTI spot price reached an all-time low of -$36.98, which was the first time that a negative spot price has been recorded. Nevertheless, spot prices only stayed negative for a single day. Due to the volatility of the daily crude oil spot prices, a more representative price is the monthly average crude oil spot price for April 2020 of $16.55. The last time the WTI average monthly spot price was this low was over 21 years ago for the month of March 1999 ($14.66). April’s price collapse resulted from both a price war between OPEC and Russia beginning in early March as well as reduced demand for oil due to the spread of COVID-19 and the resulting international response.

While prices did partially recover to $39.27 by the end of Q2, this price is still substantially below historical averages and will result in reduced investment spending and permanent job loss in Canada. Oil producing provinces will be hit disproportionately but spill over effects will be felt across the country.

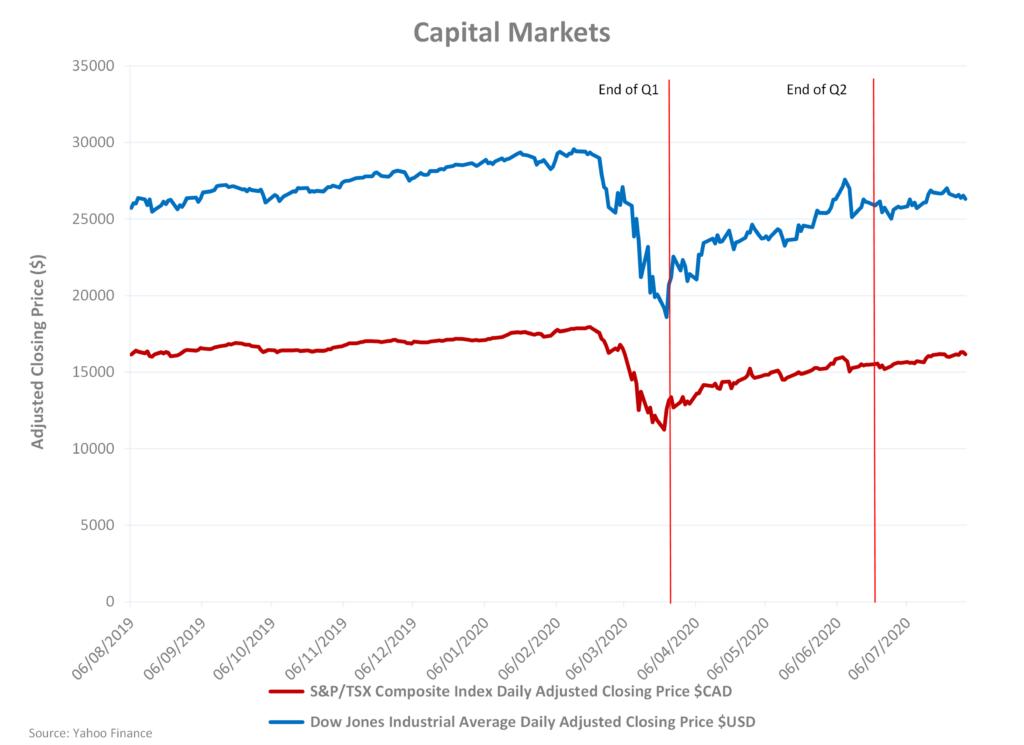

Capital Markets

The international response to COVID-19 at the beginning of March negatively impacted the current and anticipated operations of many privately-owned and publicly traded North American businesses. For publicly traded companies this impact is evident in changes in capital markets during the period. During Q1 2020, the Dow Jones Industrial Average (DJIA) and S&P/TSX Composite index[1] decreased by 23.2% and 21.6%, respectively. During Q2, the DJIA and S&P/TSX Composite index increased by 37.7% and 38.2%, respectively. As time passes and the COVID-19 curve flattens, the capital markets should become less volatile offering more stability for investors.

It will be difficult to gauge the full impact of COVID-19 on the Canadian, BC, and regional economies until the world has recovered from the pandemic. The metrics we have analysed indicate a slightly more optimistic outcome; with a current economic forecast making a near recovery by the end of 2021. Business owners will benefit from taking advantage of the fiscal stimulus provided by our governments refinancing their existing debts with the historically low interest rates.

[1] In 1977, the TSE 300 index was created, comprising of the 300 largest companies on the TSX. In 2002, Standard and Poor’s took responsibility of the index and renamed it the “S&P/TSX Composite Index”.