COVID-19 had a significant impact on the Canadian economy in Q3 of 2020 much like the prior two quarters of 2020. Nevertheless, active COVID-19 cases in Canada halved from July 1 to September 30. Likely as a result of the decline in cases a number of public safety measures were relaxed across the country during Q3. BC remained in Phase 3 of BC’s Restart Plan throughout Q3 and is expected to remain in this phase for the near-term. As mentioned in previous posts, Canada and BC have been offering financial support to aid people and businesses recover from the stagnant and uncertain economic environment. This article gives readers an update from Q2 to Q3 of 2020 of selected economic indicators. The indicators discussed herein are both indicative and representative of the Canadian, BC, and regional economies.

Labour Market

The labour force refers to the supply (employees) and demand (employers) for labour. The number of labour force participants and the unemployment rate are indicators that highlight the material changes that took place in the labour market from Q2 to Q3.

The federal government initiated the Canadian Emergency Response Benefit (CERB) as a financial support for those who were temporarily out of work. The CERB ended on September 26, 2020, but the federal government transitioned to a new initiative, the Canada Recovery Benefit (CRB) to support those temporarily out of work or those who have seen a 50% reduction or greater in average weekly income. Additionally, the Canadian Government initiated the Canada Recovery Sickness Benefit (CRSB) to provide support for those who are forced to self-isolate due to COVID-19. The Canada Emergency Wage Subsidy (CEWS) is another fiscal stimulus initiative introduced by the federal government with the aim of supporting pandemic affected businesses retain their employees. Application deadlines have been extended to January 31, 2021 for all periods of the subsidy starting March 5, 2020.

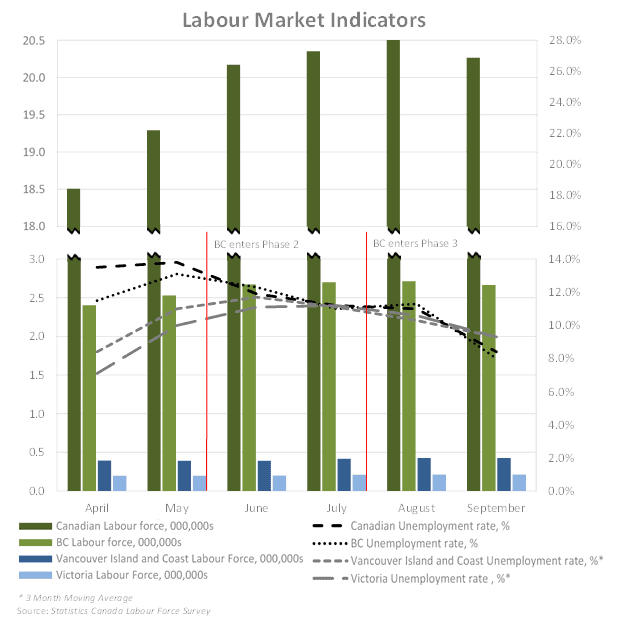

Before the impact of COVID-19, Canada was experiencing a steady increase in labour force participants. As of September 30, 2020, the Canadian labour force consisted of 20.3 million people; the same size as during February 2020 (pre-COVID-19). This signifies a remarkable recovery during May to September 2020, as 1.8 million people joined, or re-joined, the Canadian labour force.

Nevertheless, a large portion of Canadians remain unemployed. The Canadian unemployment rate was 8.4% in September 2020, which is 3.0% higher than in February 2020, before the pandemic. While the national unemployment rate has not yet returned to pre-pandemic levels, it has recovered significantly from the high of 13.8% during May 2020; a level which had not been seen since the stock market crash in 1987.

Similarly, BC’s unemployment rate decreased from a high of 13.1% in May to 8.0% at the end of Q3. Victoria and the Vancouver Island and Coast region’s unemployment rates witnessed smaller decreases from highs in June of 11.1% and 11.4% to 9.3% for both regions, respectively. Uncharacteristically, Victoria and the Vancouver Island and Coast region’s unemployment rates ended the quarter above both the provincial and national averages for September.

Gross Domestic Product (GDP)

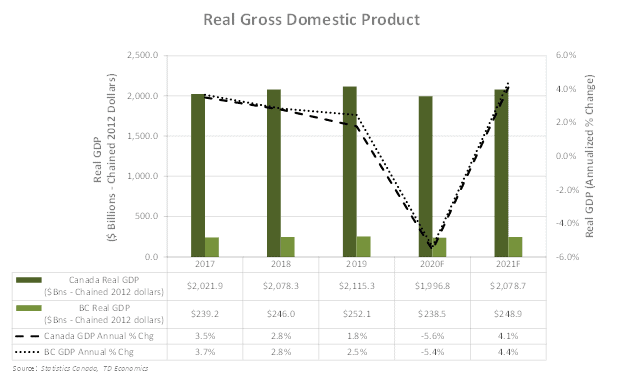

TD Economics’ annual forecast of the percent change of the Canadian GDP for 2020 as of the end of Q3 is -5.6%, which is more optimistic than the Q2 forecast of -6.1%. TD Economics also expects a national GDP rebound in 2021 as the COVID-19 threat starts to become mitigated through vaccinations, with a year over year recovery of 4.1% in 2021.

British Columbia’s annual GDP forecast follows a similar trend to Canada’s, with TD Economics’ current forecast reflects a contraction of 5.4% for 2020, which is improved from the 5.6% contraction forecast at the end of June 2020. BC can expect a strong recovery for 2021, with current forecasts predicting an economic expansion of 4.4% over 2020, which would result in a GDP of $248.9 billion, just above BC’s 2018 GDP. As BC is expected to remain in Phase 3 of its Restart Plan for the near-term, the economy, and primarily the service industries, will continue to be subject to preventative COVID-19 safety measures, which may only be lessened upon widespread vaccination.

Housing Market

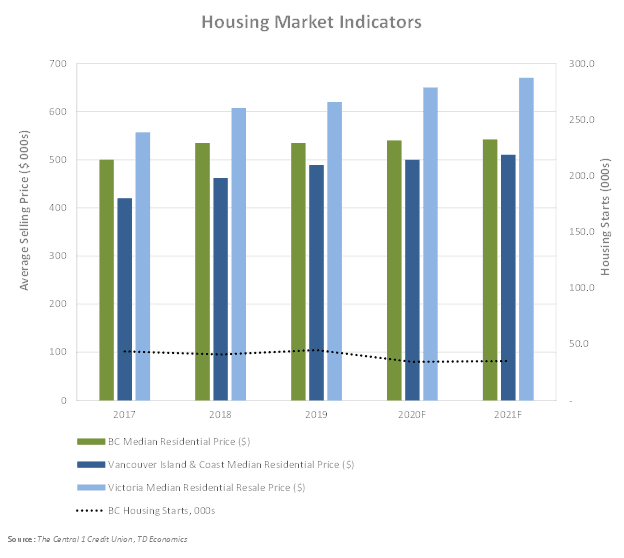

Housing starts and median residential prices reflect market indicators with strong correlation to both the construction and real estate industries. BC’s housing starts are forecast to drop by 33.2% from 2019 to 2020 (Q2 forecast -22%) and are forecast to increase by 13.3% from 2020 to 2021(Q2 forecast 3.7%). BC is also expected to see a drop in residential resale transactions of 5.6% from 2019 to 2020 with a 16.8% rebound forecast for 2021.

The volume of BC home sales during Q3 increased by 58.8% over Q2. This sudden rebound in residential property sales has had little effect on BC’s forecasted 2020 median residential price forecast which has grown by less than a percent over last year’s median residential price. Q3’s forecast for 2021 also shows nominal increase in the median residential price for BC. In contrast, the median residential price for the Vancouver Island and Coast region is expected to increase at a rate of 2.2% for 2020 and 2.0% for 2021. Victoria’s median residential resale price is forecast to have a more substantial increase of 4.8% for 2020 and 3.1% for 2021.

Interest Rates & Foreign Exchange

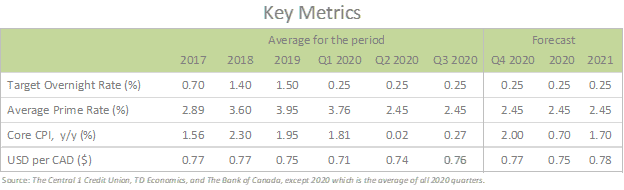

The Bank of Canada (BoC) is expected to maintain the overnight target rate at its lower limit of 0.25% until 2023. (The last time the target rate was this low was in 2009 following the financial crisis.)

This low overnight target rate has led to a significant decrease of the prime rate, allowing Canadian business owners to obtain lower cost financing and consider refinancing existing debt at lower rates. As a result of the series of rate cuts, the prime rate decreased to 2.45% and is forecast to remain at this level into the beginning of 2022.

Canada’s annual inflation rate ranged from 1.6% to 2.3% during the three years ended 2019. Due to the nation’s expected GDP contraction for 2020, the current inflation forecast is 1.6% for 2020, which is up from the prior quarter (Q2: 1.1%).

For the three years ended 2019, the average annual USD:CAD exchange rate was consistently between $0.75 and $0.77 USD. Q1 of 2020 presented some challenges for the CAD as it fell below this range to average $0.71 USD for the quarter; however, during Q2 the CAD regained some strength relative to the USD, increasing to average $0.74 USD for the quarter. The CAD continued to bolster versus the USD during Q3, averaging $0.75 USD for the quarter. The average annual USD:CAD exchange rate for 2020 is forecast to be $0.75 USD, increasing to $0.78 USD for 2021.

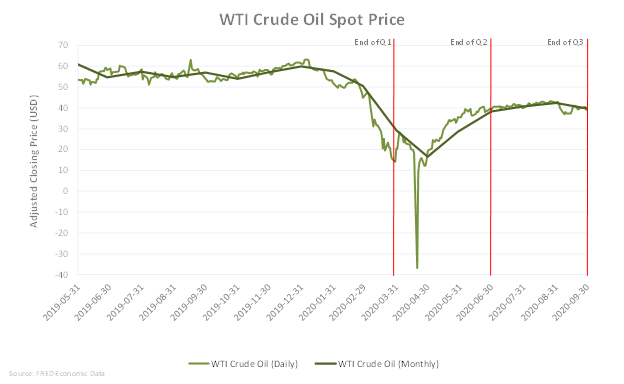

Crude Oil Prices

In 2019, Canada produced 4.7 million barrels per day (MMb/d), imported 0.8 MMb/d, and exported 3.8 MMb/d of crude oil. As a net oil exporter, the Canadian economy is heavily impacted by the price of crude oil with the greatest impact felt in Canada’s major oil producing provinces. The majority of Canadian crude oil is produced in Alberta (81%), Saskatchewan (10%), and Newfoundland and Labrador (6%). In North America, the West Texas Intermediate (WTI) crude oil spot price is used as the benchmark oil price.

Historical WTI crude oil spot prices (as of September 30, 2020):

- 20-year average: $62.10

- 10-year average: $69.50

- 5-year average: $51.01

- 3-year average: $54.79

- 2019 annual average: $56.98

Analysts are cautiously optimistic when it comes to forecasting oil prices. Deloitte’s Price forecast for Oil, gas & chemicals reminds us that the oil and gas industry is going through two crises simultaneously: (1) decreased demand due to COVID-19 and (2) price collapse due to a price war between OPEC and Russia. The ongoing effects of these crises are largely unpredictable, and thus oil demand forecasts continue to be volatile, leaving the industry open to oversupply. Despite this risk, during Q3 WTI oil prices beat most analysts’ expectations to range from $36.87 to $43.21, and stabilized somewhat around the quarterly average of $40.89.

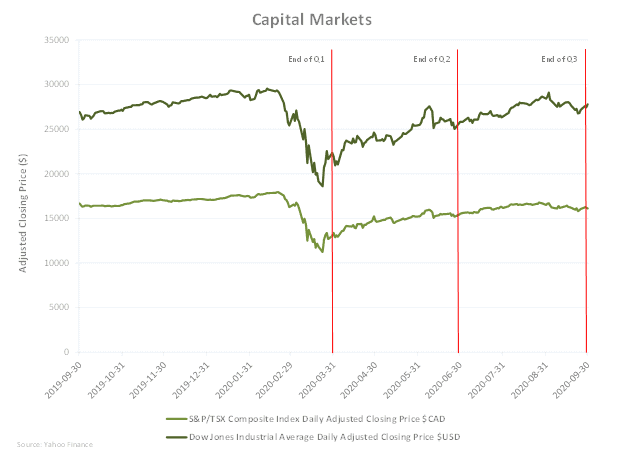

Capital Markets

The international response to COVID-19 at the beginning of March negatively impacted the current and anticipated operations of many privately-owned and publicly traded North American businesses. For publicly traded companies this impact is evident in changes in capital markets during the period. As at September 30, 2020 the year-to-date percentage loss for the Dow Jones Industrial Average (DJIA) and S&P/TSX Composite index are 3.8% and 5.7%, respectively. As at September 30 these indexes were 16,242 and 27,584, respectively which are shy of their pre-COVID levels of 17,044 and 29,551, respectively.

It will be difficult to gauge the full impact of COVID-19 on the Canadian, BC, and regional economies until the world has recovered from the pandemic. The metrics we have analysed indicate an optimistic outcome; with a current economic forecast making a near recovery by the end of 2021. Business owners will benefit from taking advantage of the fiscal stimulus provided by our governments refinancing their existing debts with the historically low interest rates.

Shortly after the close of Q3 COVID-19 vaccine trials have produced effective vaccines that are expected to be approved and released globally starting with high risk groups in Q4 of 2020. Our Q4 Economic Update will report more on how this may affect Canada’s economic outlook.

A glossary of all defined terms can be found here.

[1] In 1977, the TSE 300 index was created, comprising of the 300 largest companies on the TSX. In 2002, Standard and Poor’s took responsibility of the index and renamed it the “S&P/TSX Composite Index”.