The Canadian economy remains below pre-pandemic levels according to many metrics, but the promise of widespread vaccination will be a driving force of economic growth carrying Canadians the rest of the way out of the COVID-19 induced recession. Canadian businesses in hard hit sectors such as tourism, travel, restaurants, and accommodation are looking toward national and provincial policy makers for relief. Understanding this, the Bank of Canada will continue to provide monetary stimulus liberally until the economy is near-matching pre-pandemic output.

BC remained in Phase 3 of BC’s Restart Plan throughout Q4 and is expected to remain in this phase for the near-term. As mentioned in previous posts, Canada and BC have been offering financial support to aid people and businesses recover from the stagnant and uncertain economic environment. This article gives readers an update from Q3 to Q4 of 2020 of selected economic indicators. The indicators discussed herein are both indicative and representative of the Canadian, BC, and regional economies.

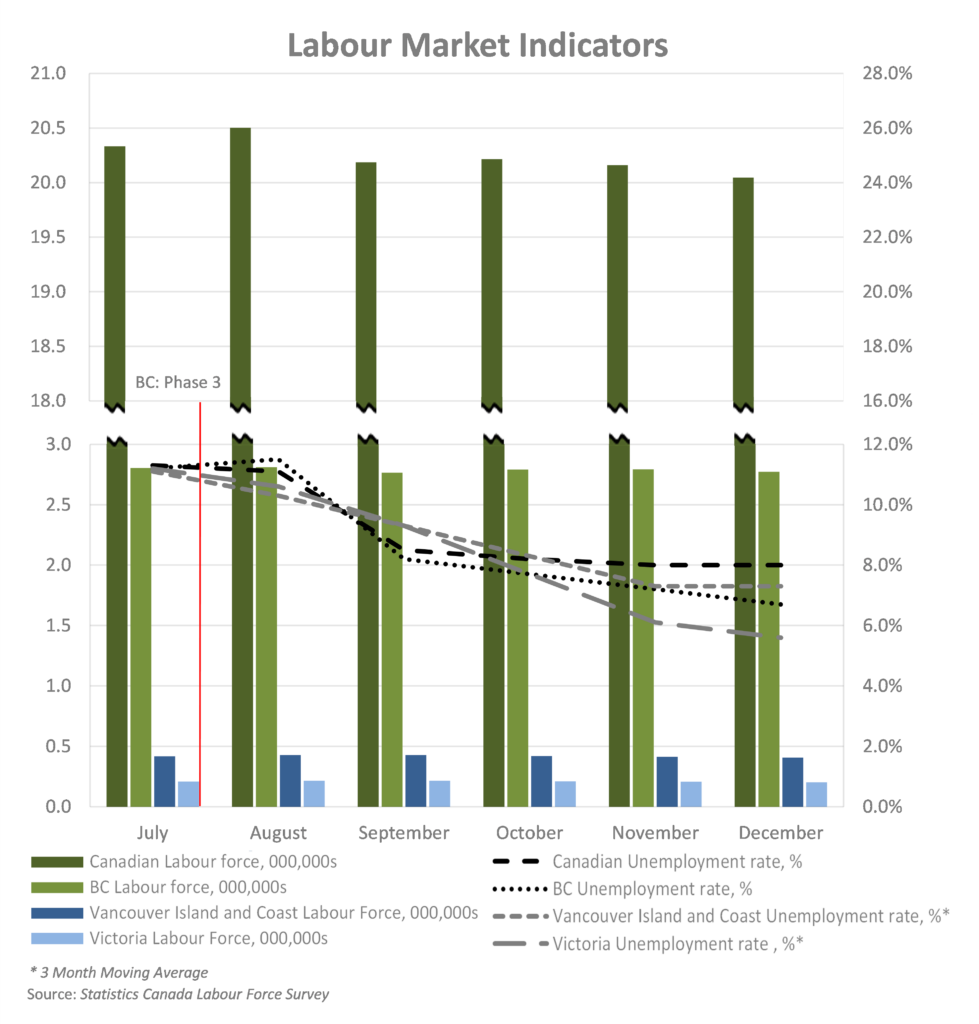

Labour Market

The labour force refers to the supply (employees) and demand (employers) for labour. The number of labour force participants and the unemployment rate are indicators that highlight the material changes that took place in the labour market from Q3 to Q4.

The federal government has initiated a number of programs to support employers and employees impacted by COVID -19. In Q3 2020, Canada introduced the Canada Recovery Benefit (CRB) to support those temporarily out of work or those who have seen a 50% or greater reduction in their average weekly income. Additionally, the Government initiated the Canada Recovery Sickness Benefit (CRSB) to provide support for those who are forced to self-isolate due to COVID-19. The Canada Emergency Wage Subsidy (CEWS) is another fiscal stimulus initiative introduced by the federal government with the aim of supporting pandemic affected businesses retain their employees.

Before the impact of COVID-19, Canada was experiencing a steady increase in labour force participants. As of September 30, 2020, the Canadian labour force consisted of 20.3 million people; the same size as during February 2020 (pre-COVID-19). This result signifies a remarkable recovery during May to September 2020, as 1.8 million people joined, or re-joined, the Canadian labour force.

Before the impact of COVID-19, Canada was experiencing a steady increase in labour force participants. As of December 31, 2020, the Canadian labour force consisted of 20.0 million people, a reduction of approximately 455,400 participants since August’s period high of 20.5 million. However, the reduction was not borne evenly through age groups: the labour pool of individuals aged 15 to 24 saw a reduction of 589,100 participants, while the labour pool of other age group actually experienced an increase in participation. A large portion of Canadians remain unemployed during Q4 relative to recent historical levels. The Canadian unemployment rate was 8.0% for the month of December 2020, which is 2.1% higher than in February 2020, immediately before the pandemic. While the national unemployment rate has not yet returned to pre-pandemic levels, it has recovered significantly from the high of 13.8% during May 2020; a level which had not been seen since the stock market crash in 1987.

BC’s unemployment rate decreased from a high of 13.1% in May to 6.7% at the end of December 2020. Victoria and the Vancouver Island and Coast region’s unemployment rates witnessed similar decreases during 2020, from highs in June of 11.1% and 11.4% to 5.6% and 7.3%, respectively. Victoria and the Vancouver Island and Coast region’s unemployment rates ended the year below the provincial and national rates.

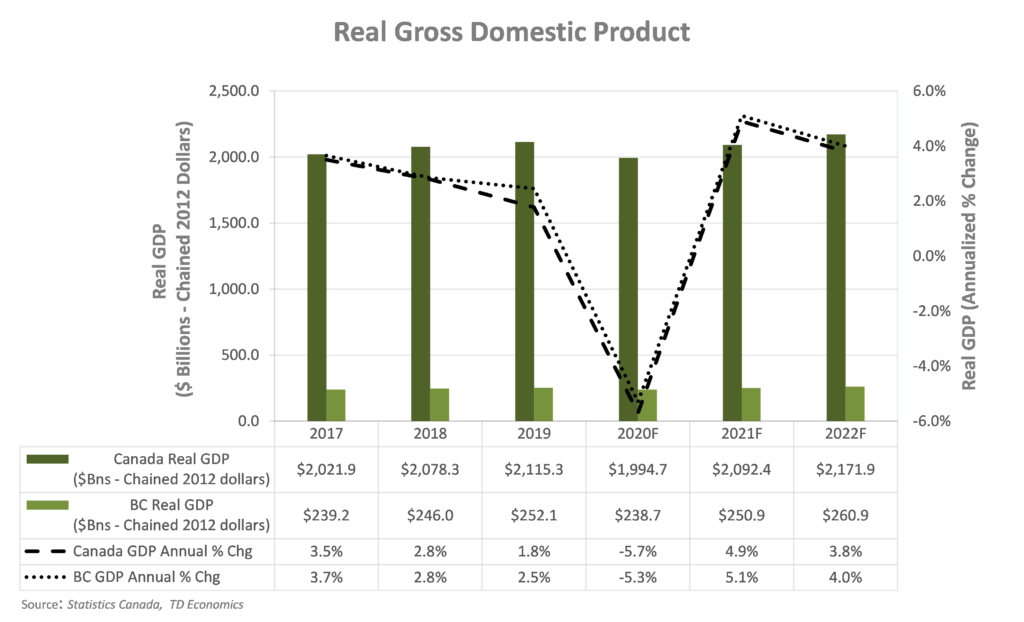

Gross Domestic Product (GDP)

TD Economics’ annual forecast of the year-over-year percent change of the Canadian GDP for 2020 as of the end of December 2020 is -5.7% which is in line with their forecast at the end of Q3. TD Economics also expects a national GDP rebound in 2021 as the COVID-19 threat becomes mitigated through vaccinations, with a year over year recovery of 4.9% in 2021.

British Columbia’s annual GDP forecast follows a similar trend to Canada’s, with TD Economics’ current forecast reflecting a contraction of 5.3% for 2020, which is improved from the 5.6% contraction forecast at the end of September 2020. BC forecasts for Q4 predict an economic expansion of 5.1% over 2021, which would result in a GDP of $250.9 billion which is just above BC’s 2019 GDP. As BC is expected to remain in Phase 3 of its Restart Plan for the near-term, the economy, and primarily the service industries, will continue to be subject to preventative COVID-19 safety measures, which may only be lessened upon widespread vaccination.

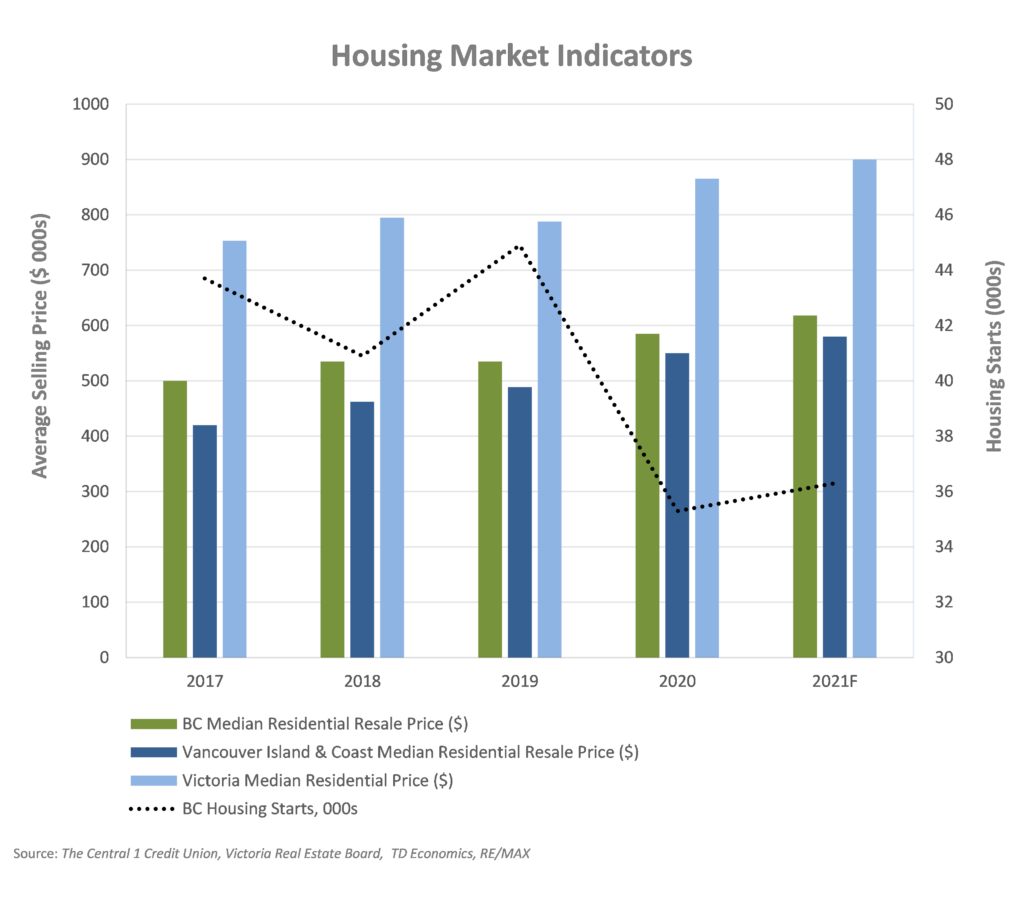

Housing Market

Housing starts and median residential prices reflect market indicators with strong correlation to both the construction and real estate industries. BC’s housing starts dropped by 21.4% from 2019 to 2020 (Q3 forecast -33.2%) and are forecast to increase by 3.8% from 2020 to 2021 (Q3 forecast 13.3%). BC saw an increase in residential resale transactions of 20.2% from 2019 to 2020 (Q3 forecast -5.6%) with a further increase of 11.9% rebound for 2021 (Q3 forecast 16.8%).

In BC, residential resale median prices have shown a substantial increase of 9.3% from 2019 to 2020 despite the COVID-19 induced recession. A further increase of 5.6% in the median residential resale price for BC is forecast for 2021.

The median residential price for the Vancouver Island and Coast region increased at a rate of 12.5% for 2020 (Q3 forecast: 2.2%) surpassing expectations and is projected to increase another 5.5% (Q3 forecast: 2.0%) between 2020 and 2021. Greater Victoria’s median residential prices increased by 9.8% during 2020 and are projected to increase a further 5.0% for 2021.

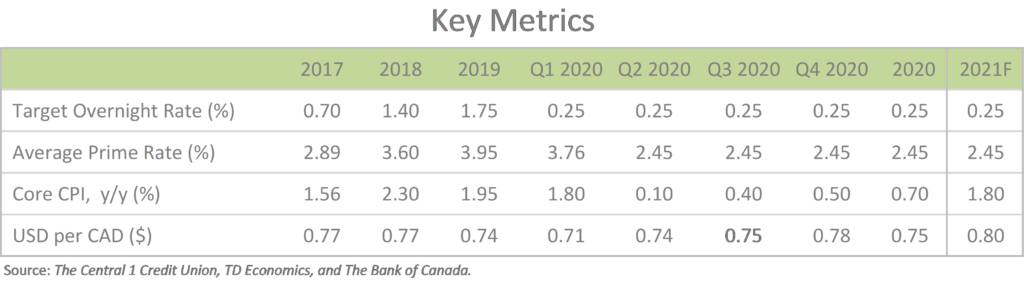

Interest Rates & Foreign Exchange

The Bank of Canada (BoC) is expected to maintain the overnight target rate at its lower limit of 0.25% until 2023. The last time the target rate was this low was in 2009 following the financial crisis.

This low overnight target rate has led to a significant decrease of the prime rate, allowing Canadian business owners to obtain lower cost financing and consider refinancing existing debt at lower rates. As a result of the series of rate cuts, the prime rate decreased to 2.45% and is forecast to remain at this level into the beginning of 2022.

Canada’s annual inflation rate ranged from 0.7% to 2.3% during the four years ended 2020. Due to the nation’s GDP contraction for 2020, the current inflation forecast is 1.8% for 2021, which is up from the Q3 forecast.

For the four years ended 2020, the average annual USD:CAD exchange rate was consistently between $0.75 and $0.74 USD. Q1 of 2020 presented some challenges for the CAD as it fell below this range to average $0.71 USD for the quarter but rebounded to historical levels during Q2 to average $0.74 USD for the quarter. The CAD rose versus the USD during both Q3 and Q4, averaging $0.75 and $0.78 USD, respectively. The average annual USD:CAD exchange rate for 2020 was $0.75 USD, which is in-line with recent historical rates. However, for 2021, the CAD is projected to further appreciate versus the USD to $0.80, as the USD is forecast to continue weakening versus the major international currencies.

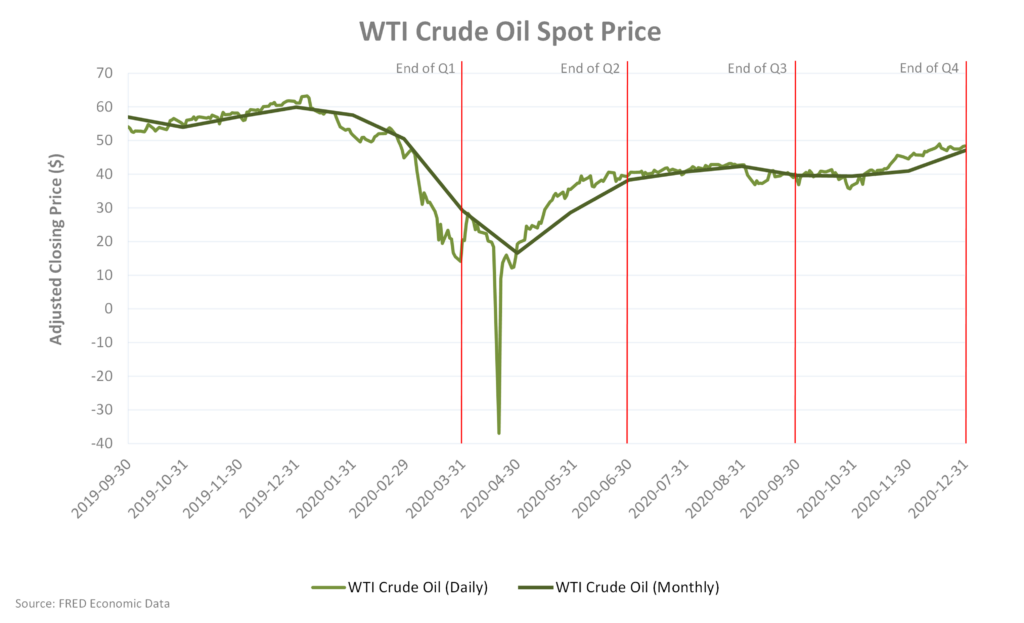

Crude Oil Prices

In 2019, Canada produced 4.7 million barrels per day (MMb/d), imported 0.8 MMb/d, and exported 3.8 MMb/d of crude oil. As a net oil exporter, the Canadian economy is heavily impacted by the price of crude oil, with the greatest impact felt in Canada’s major oil producing provinces. The majority of Canadian crude oil is produced in Alberta (81%), Saskatchewan (10%), and Newfoundland and Labrador (6%). In North America, the West Texas Intermediate (WTI) crude oil spot price is used as the benchmark oil price.

Historical WTI crude oil spot prices (as of December 31, 2020):

- 20-year average: $62.10

- 10-year average: $69.50

- 5-year average: $51.01

- 3-year average: $54.79

- 2019 annual average: $56.98

- 2020 average: $39.16

Analysts are cautiously optimistic when it comes to forecasting oil prices. Throughout the year, the oil and gas industry underwent two crises: (a) decreased demand due to COVID-19 and (b) price collapse due to a price war between OPEC and Russia. Both crises have led to oversupply risks across the industry. Over the course of Q4, WTI oil prices saw stable growth from $38.51 to $48.35. This stable growth can be attributed to the reduction in impact of both ongoing crises. Pharmaceutical companies making vaccine announcements in November has led to significant increases in demand and OPEC announced plans to meet that demand in December by increasing their oil supply by 500,000 b/d starting in January of 2021. In the near-term this should result in a relatively flat crude oil spot price.

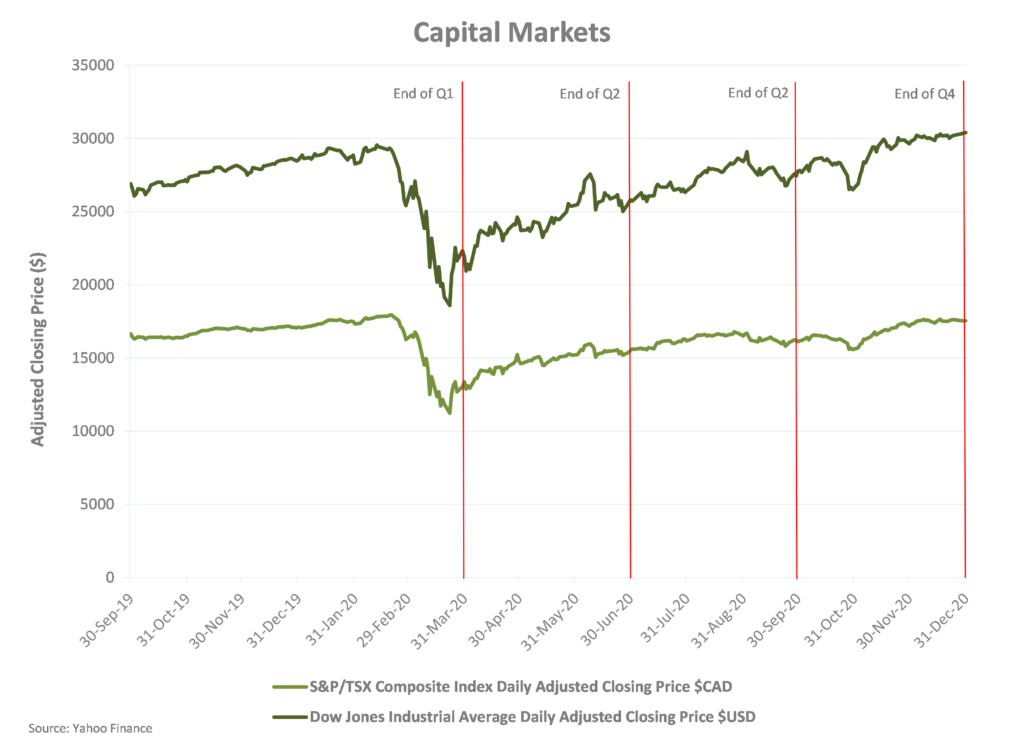

Capital Markets

The international response to COVID-19 at the beginning of March negatively impacted the current and anticipated operations of many privately-owned and publicly traded North American businesses. For publicly traded companies this impact is evident in changes in capital markets during the period. As at December 31, 2020 the year-to-date percentage gain for the Dow Jones Industrial Average (DJIA) and S&P/TSX Composite index are 5.34% and 2.81%, respectively. In Q4, these indices saw a percentage gain of 8.41% and 9.32% respectively. As at December 31, 2020 the DJIA was at an all-time high of 30,410 having well surpassed its pre-pandemic level of 29,551. The S&P/TSX Composite index, while technically not at its all-time high, was sitting at 17,546 having surpassed its pre-pandemic level of 17,044.

Although capital markets have fully recovered, it is important to note that the actions investors are taking are largely optimistic and are based on forward looking assumptions and analysis. As we have covered in the other sections of this report, global and Canadian economies are still struggling to overcome the impact of COVID-19.

At the close of 2020, We can look back and see the dramatic recession largely due to the impact of COVID-19. Nevertheless, it will be difficult to gauge the full impact of COVID-19 on the Canadian, BC, and regional economies until the world has recovered from the pandemic. The metrics we have analysed indicate an optimistic outcome; with a current economic forecast making a near recovery by the end of 2021. Business owners will benefit from taking advantage of the fiscal stimulus provided by our governments refinancing their existing debts with the historically low interest rates.

Shortly after the close of Q3 COVID-19 vaccine trials have produced effective vaccines that are being deployed worldwide. Unfortunately for Canadians, vaccines are not reaching the public quickly and as a result, COVID-19, and the resulting restrictions, will continue to play a part in the lives of Canadians and the economy.

A glossary of all defined terms can be found here.

[1] In 1977, the TSE 300 index was created, comprising of the 300 largest companies on the TSX. In 2002, Standard and Poor’s took responsibility of the index and renamed it the “S&P/TSX Composite Index”.