The Canadian economy has returned to (or is forecast to exceed) the pre-pandemic levels of major economic indicators by the end of 2021. Nevertheless, Canada’s unemployment rate is forecast to remain above pre-pandemic levels throughout Quarter 2 of 2021. Similarly, economic indicators for BC have returned to or exceeded levels prior to the COVID-19 induced recession for the province. BC’s immunization plan, which utilizes the Pfizer and Moderna vaccines, is currently in Phase 3 and is expected to reach the final Phase during the next quarter. More than 36 million vaccine doses have been administered across the nation by the end of Q2.

In Q2, BC implemented its Restart Plan, a four-step plan based on immunization rates and COVID-19 hospitalization targets. The Province moved from Step 1 (60% of those 18+ with 1 dose) to Step 2 (65% with 1 dose), announced Step 3 (70% with 1 dose) would begin at the start of Q3, and expects to move to Step 4 (>70% with 1 dose) by the end of Q3. Upon reaching Step 4, the majority of province-wide restrictions will have been lifted. As mentioned in previous posts, Canada and BC have been offering financial support to aid people and businesses recover from the uncertain economic environment. This article gives readers an update from Q1 2021 to Q2 2021 of selected economic indicators. The indicators discussed herein are both indicative and representative of the Canadian, BC, and regional economies.

Labour Market

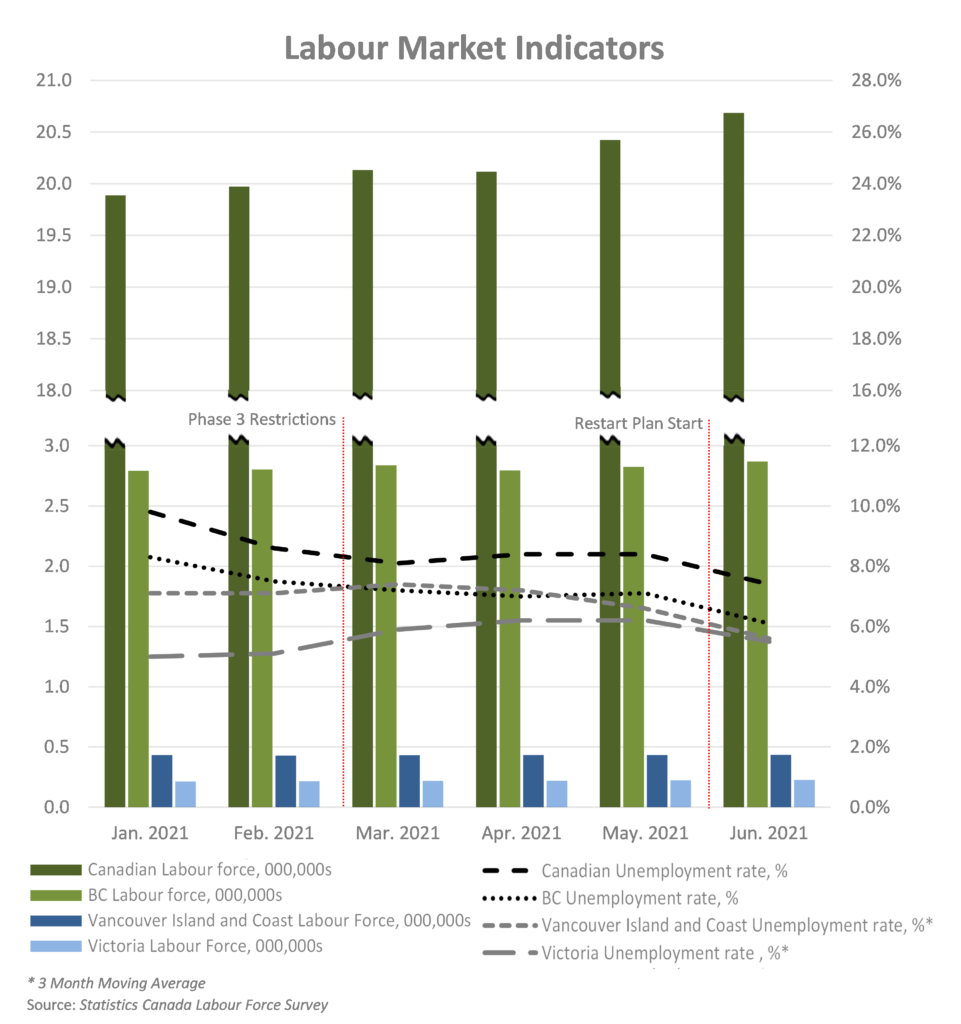

The labour force refers to the supply (employees) and demand (employers) for labour. The number of labour force participants and the unemployment rate are indicators that highlight the material changes that took place in the labour market from Q1 2021 to Q2 2021.

The federal government has initiated several programs to support employers and employees impacted by COVID-19, which were expanded during Q2. In June, Canada initiated the Canada Recovery Hiring Program (CRHP) to further support Canadian businesses cover part of their employee wages. Effective as of April 2021, the Government of Canada has suspended the accumulation of interest on Canada student loans until March of 2022 and doubled the number of grants for full-time and part-time students. Furthermore, the government has extended the COVID-19 support programs, which includes the Canada Recovery Benefit (CRB),the Canada Emergency Wage Subsidy (CEWS), and the Canada Recovery Sickness Benefit (CRSB), until September 25, 2021.

Before the impact of COVID-19, Canada was experiencing a steady increase in labour force participants. As of June 30, 2021, the Canadian labour force consisted of 20.7 million people, an increase of approximately 553,000 participants since the end of Q1 2021. The Canadian unemployment rate decreased from 8.40% at the start of Q2 to 7.40% by the end, a decrease of 0.70% over the quarter; however, the quarter closing rate is still 1.50% higher than the pre-pandemic rate. Unemployment rates are expected to continue to decrease as vaccination rates increase (at the end of June 2021, 77.00% of Canadians had received their first dose).

BC’s unemployment rate reflected the national trend decreasing from 7.00% to 6.10% over the quarter; however, the closing rate is 1.10% higher than February 2020’s pre-pandemic rate. The unemployment rate for Victoria increased at the start of the quarter to 6.20% (from March 2020’s 5.90%) but by the end of the quarter it had decreased to 5.50%. Nevertheless, this rate is still significantly higher than the pre-pandemic rate of 3.50%. Vancouver Island and Coastal regions witnessed a decrease from 7.40% to 5.60% over the quarter and nearly reached the pre-pandemic rate of 5.30%.

BC’s Immunization Plan progressed into Phases 3 and 4, in which the general population (as opposed to high-risk population) aged 79 to 18 are eligible to receive a first vaccine dose. Second doses and first doses for those over 12 are expected to be administered in Q3.

Gross Domestic Product (GDP)

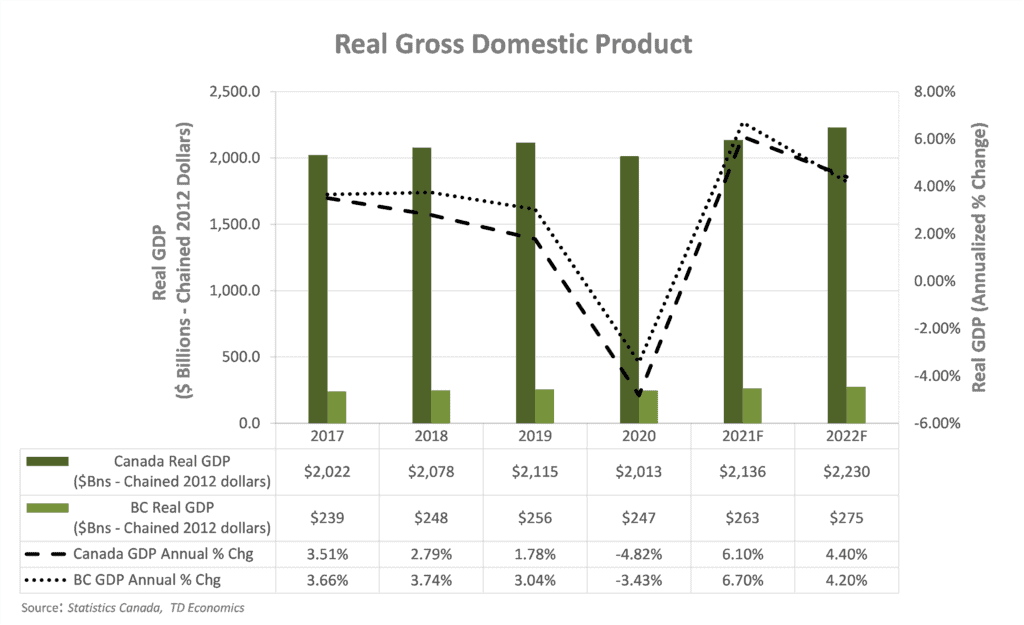

As posted in the previous update, Canada’s real GDP for 2020 declined by -4.82% over the prior year. TD Economics (TDE) forecasts real GDP to grow by 6.10% for 2021 and exceed pre-pandemic levels due to fewer health restrictions and increased vaccinations. This GDP forecast exceeds the forecast provided in the prior quarter by 0.10%.

TDE forecasts an upturn in the BC economy resulting in a real GDP increase of 6.70% for 2021, which is 0.40% higher than predicted during Q1 of 2021. The resulting forecast GDP of $263 billion would exceed pre-pandemic levels. During Q2, BC reached Step 2 of its Restart Plan which increased the number of people permitted to attend indoor and outdoor gatherings. BC is expected to move into Step 3 on July 1, 2020 which will further ease restrictions and is expected to result in further economic growth.

Housing Market

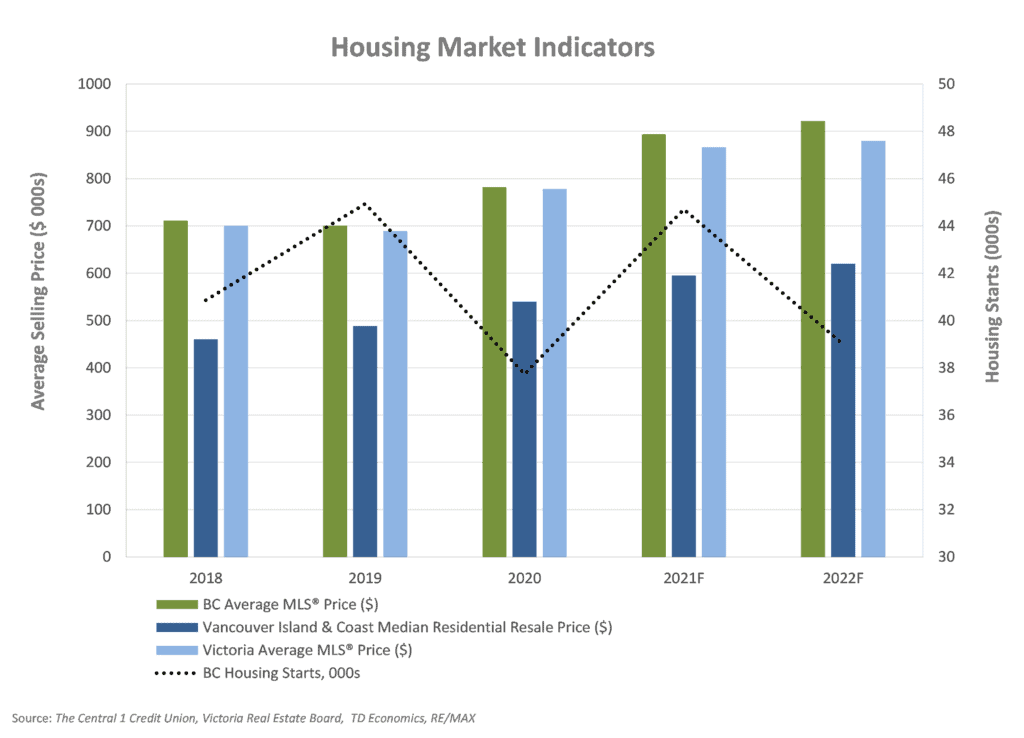

Housing starts and average residential prices reflect market indicators with strong correlation to both the construction and real estate industries. BC’s housing starts dropped by 16.02% from 2019 to 2020. The BC Real Estate Association (BCREA) forecasts an increase of 18.46% from 2020 to 2021 followed by a decrease of 12.75% from 2021 to 2022.

The residential average price in BC has increased substantially despite the COVID-19 induced recession. The MLS® Home Price Index (HPI) provides a measure of real estate prices over time by dividing the total dollar volume of sales by the number of sales for a region. The HPI exceeded historical records for all regions of BC by the end of Q2. BCREA forecast an increase of 14.33% in the average price of single-detached homes for 2021 and an increase of 3.13% for 2022. Average prices for Victoria, BC are forecast to increase by 11.34% and 1.59% for 2021 and 2022, respectively.

Interest Rates & Foreign Exchange

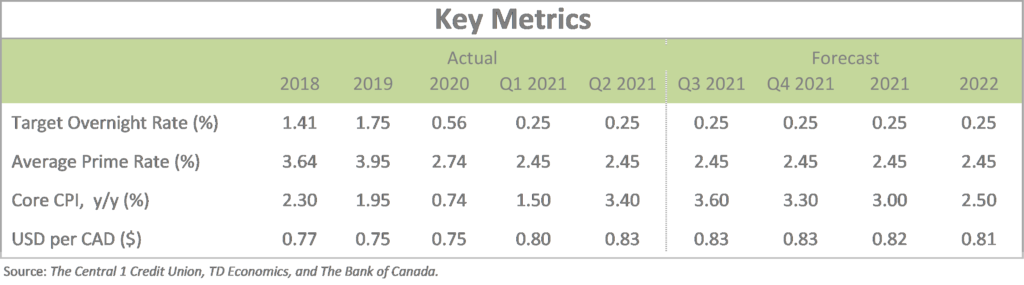

The Bank of Canada (BoC) expects to maintain the overnight target rate at its lower limit of 0.25% until its inflation objective is sustainably achieved. The last time the target rate was this low was in 2009 following the financial crisis.

The low overnight target rate has led to a significant decrease in the prime rate, so Canadian business owners can obtain lower cost financing and consider refinancing existing debt at lower rates. As a result of the series of rate cuts, the average prime rate was 2.45% for Q2. The prime rate is forecast to remain at this level into the beginning of 2022.

Until the end of 2021, the BoC inflation-control target is 2%, the midpoint of its target 1% to 3%. TDE expects inflation to increase by 2.90% for 2021 and 2.50% for 2022, which is higher than the 1.90% and 2.40% forecast in Q1. Although these forecasts exceed the BoC midpoint target, they do fall within the BoC inflation-control target range. TDE forecasts the average annual USD to CAD exchange rate to increase to $0.82 USD/CAD, a slight increase from the Q1 forecast of $0.80 USD/CAD. The forecast for 2022 is a slight decrease to $0.81 USD/CAD.

Crude Oil Prices

Canada has the 4th largest proven oil reserves in the world. As a net oil exporter, the Canadian economy is heavily impacted by the price of crude oil with the greatest impact felt in Canada’s major oil producing provinces. The majority of Canadian crude oil production is in Alberta (81.00%), Saskatchewan (10.00%), and Newfoundland and Labrador (6.00%). In May of 2020, oil producers cut western Canadian oil supply by 972 thousand barrels per day due to low oil prices, as a result of the impact of COVID-19.

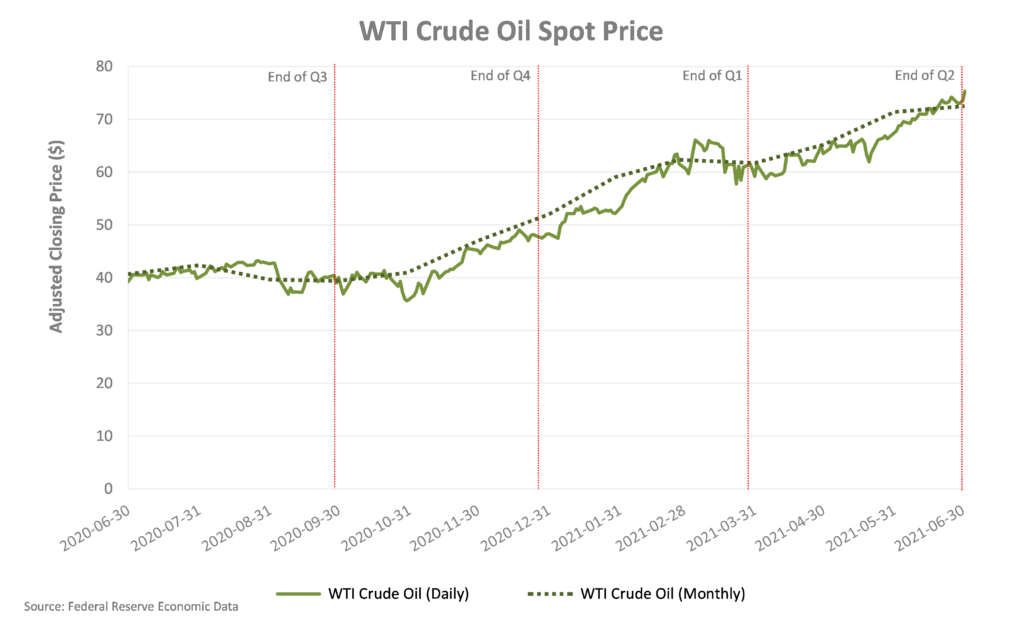

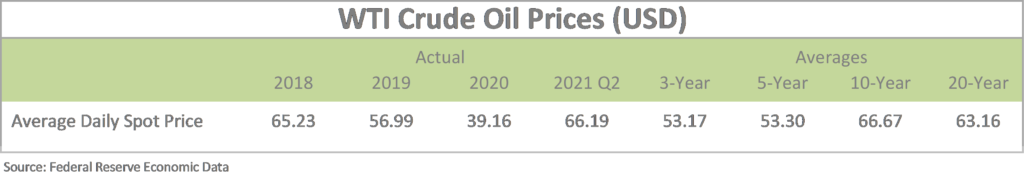

In North America, the West Texas Intermediate (WTI) crude oil spot price is the benchmark oil price. Historical WTI crude oil daily spot prices (as of June 30, 2021) were:

Over the course of Q2, WTI oil prices saw a slow but steady increase from $61.41 to $73.52, reaching a high of $74.21 on June 25th. The International Energy Agency (IEA) attributes the increase to an increase in vaccinations, with over 23.40% of the world receiving a COVID-19 vaccine, as of June 30, 2021. The IEA forecasts global oil demand to return to its pre-pandemic levels by the end of 2022.

Capital Markets

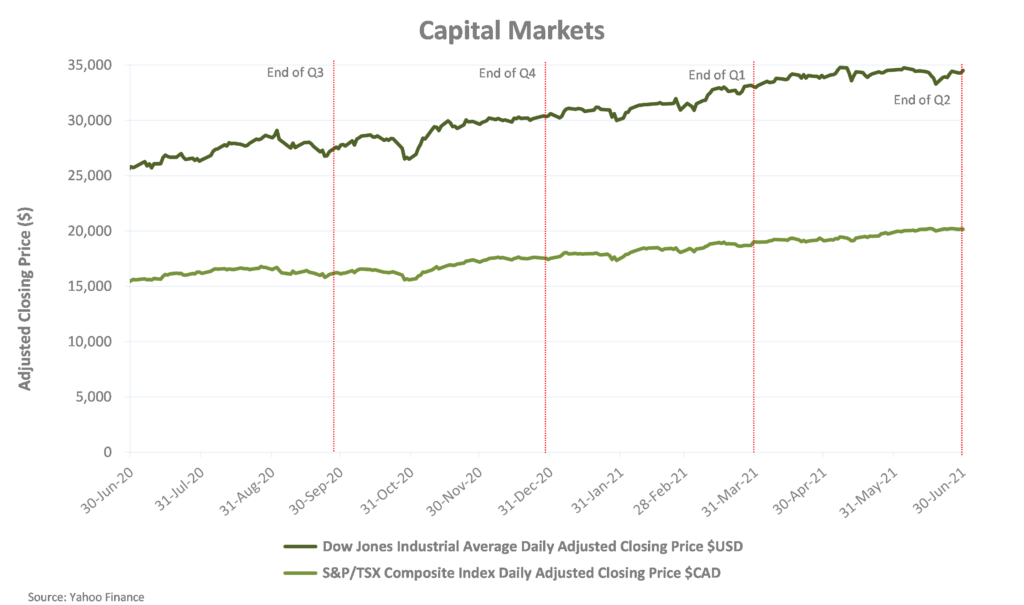

The international response to COVID-19 at the beginning of March 2020, negatively impacted the current and anticipated operations of many privately-owned and publicly traded North American businesses. This impact was evident in changes in capital markets during the period for publicly traded companies. As of June 30, 2021, the year-to-date percentage gain for the Dow Jones Industrial Average (DJIA) and S&P/TSX Composite index are 12.73% and 15.05%, respectively. During Q2 these indices saw a gain of 4.07% and 6.16%, respectively. At the end of Q2 of 2021, the DJIA surpassed the all-time high seen in Q4 of 2020 and finished Q2 at 34,503. The S&P/TSX Composite index has continued to increase past pre-pandemic levels and reached 20,282 at the end of Q2.

Although capital markets have fully recovered, it is important to note these indicators are based on forward looking assumptions and analysis, which have largely optimistic. As covered in the other sections of this post, overall, global and Canadian economies are still struggling to overcome the impact of COVID-19.

Moving into Q3 of 2021, BC expects to move into Steps 3 and 4 the Restart Plan based on immunization levels, case numbers and hospitalizations staying stable. As of June 28, 2021, 31.90% of eligible Canadians have received two doses of COVID-19 vaccine, and over 77% have received at least one dose.

Nevertheless, it will be difficult to gauge the full impact of COVID-19 on the Canadian, BC, and regional economies until the world has recovered from the pandemic. The metrics analysed indicate an optimistic outcome, with a current economic forecast making a near recovery by the end of 2021. Business owners will benefit from taking advantage of the fiscal stimulus provided by our governments and refinancing their existing debts with the historically low interest rates.

A glossary of all defined terms can be found here.

[1] In 1977, the TSE 300 index was created, comprising of the 300 largest companies on the TSX. In 2002, Standard and Poor’s took responsibility of the index and renamed it the “S&P/TSX Composite Index”.