The global economy is currently experiencing a deep Covid-19 induced recession which has had an impact on the domestic economy that Canada has not seen since the financial crisis in 2008. This post provides readers an economic update for Q1 of 2020. Economic indicators discussed herein are both indicative and fairly representative of the Canadian, provincial, and regional economies. Although there has been a sharp contraction in the economy, it is forecast to have a strong recovery. Business owners will want to keep their capital readily available to participate in the ensuing market rebound.

Labour Market

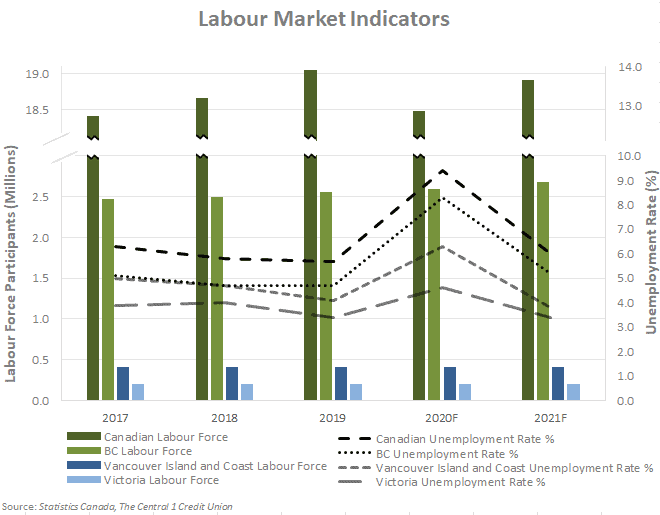

The labour market refers to the supply (employees) and demand (employers) for labour. The number of labour force participants and the unemployment rate are indicators that highlight the material changes that took place in the labour market from the end of 2019 to now. The labour force consists of individuals currently working plus those who are unemployed and looking for work. Canada has experienced a steady increase in labour force participants until the Covid-19 measures caused temporary lay-offs. Many of these individuals are simply waiting to be rehired and are subsequently excluded from the labour force which explains the significant drop in participants during Q1 2020.

Due to social distancing measures directed by the Province of British Columbia, many businesses have had to severely reduce or even halt operations, causing many layoffs during the quarter. From Q4 of 2019 to Q1 of 2020, Canada and BC’s unemployment rates have increased from 5.6% and 4.8%, to 7.8% and 7.2%, respectively. This marks the sharpest incline in the unemployment rate since 1976. The forecast for 2020 clearly shows an upward trend in the unemployment rate; however, Victoria and Vancouver Island have been somewhat less affected compared to the rest of Canada. These two regions have historically recorded some of the lowest unemployment rates nationwide. Canada and BC’s unemployment rates in 2020 are forecast to reach 9.4% and 8.3%, respectively, whereas Vancouver Island and Victoria’s unemployment rates are expected to reach 6.3% and 4.6%, respectively.

Gross Domestic Product (GDP)

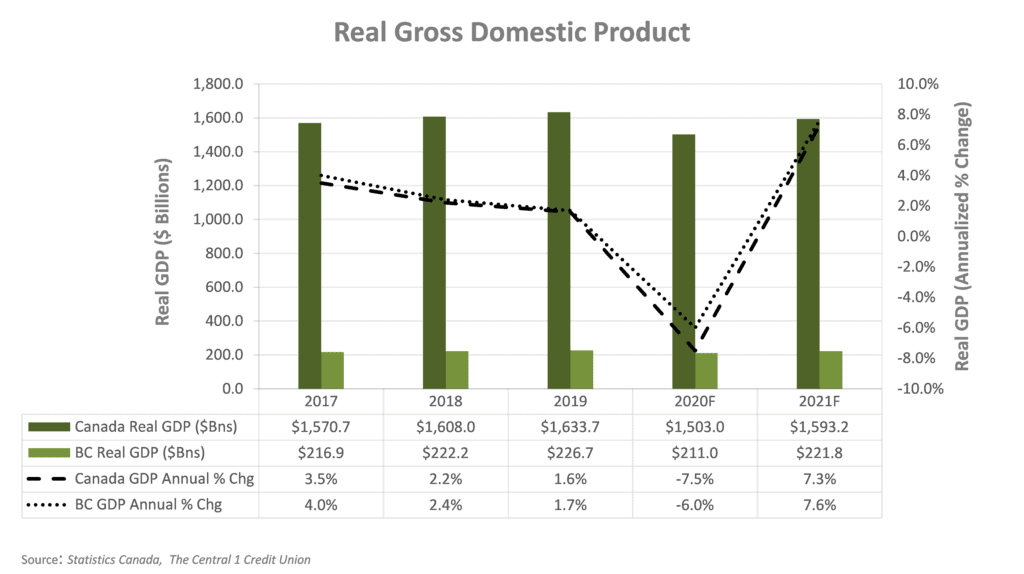

GDP is the total market value of all the finished goods and services produced in a region over a specific time period and is a common indicator in measuring the expansion or contraction of an economy. According to TD Economics, the country’s GDP in Q1 of 2020 is expected to have contracted by 9.7% since the end of 2019, with further contraction of 42.0% forecast for Q2 of 2020 followed by GDP recovery expected for Q3 and Q4. Overall, for 2020 Canada can expect to see an annual economic contraction of 7.5% in 2020 followed by a near complete economic rebound of 7.3% in 2021.

As mentioned in our previous blog post, BC’s tourism and accommodation and food service sectors were hamstrung in Q1 of 2020 by international travel bans and social distancing measures. The challenges faced by these sectors contribute significantly to the Province’s economic contraction. BC can expect to see an annual contraction of 6.0% in 2020 GDP, also with a strong rebound of 7.6% growth forecast for 2021, which will nearly return the Province’s GDP to pre-Covid-19 levels. Business owners are advised to be ready to return to normal operations with access to their labour and capital resources as the inevitable easing of social-distancing constraints marks the beginning of economic recovery and opportunity to recoup market share.

Housing Market

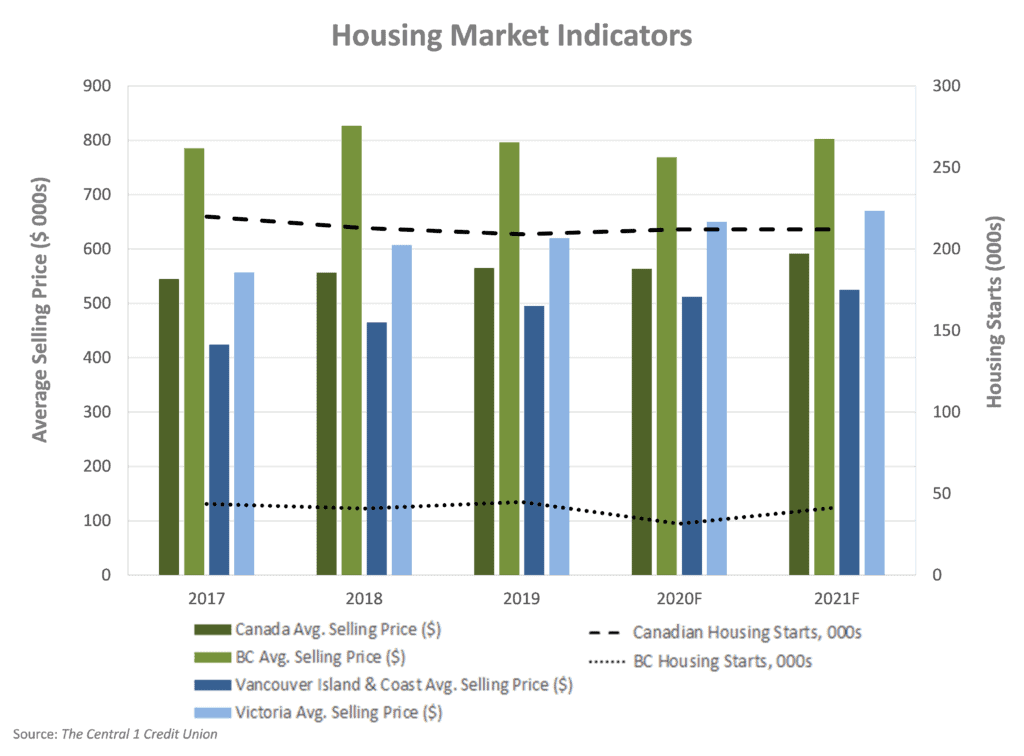

The housing market refers to the supply and demand for houses in a country or region. Housing starts and average selling price reflect market indicators with strong correlation to both the construction and real estate industry. Housing starts in Canada and BC were 25.0% and 24.2% lower, respectively, for Q1 2020 compared to the prior quarter.

As a result of the anticipated 2020 economic contraction, the average selling price of homes is expected to decrease in BC and Canada. However, the Vancouver Island and Victoria regions are predicted to not be as affected as the rest of the Province, as the housing prices are expected to remain flat or even increase, demonstrating this region’s relative resilience to external market factors.

Interest Rates & Foreign Exchange

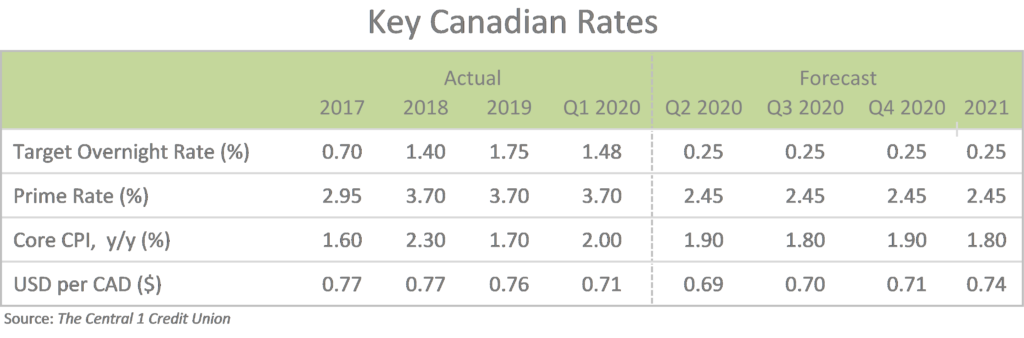

Historically, the health of the Canadian economy has had a strong correlation to crude oil prices. A decline of 66.8% in West Texas Intermediate (WTI) oil prices from the end of 2019 to the end of Q1 of 2020 has had a deflating effect on the Canadian economy. The Bank of Canada (BoC) has responded by providing both fiscal stimulus and accessibility to the credit markets. The BoC made an emergency cut in the target overnight rate on March 4 from 1.75% to 1.25%, with a second cut on March 16 to 0.75%, and a third cut on March 27 down to 0.25%. The last time the target rate was as low as 0.25% was in 2009 following the financial crisis.

The considerable reduction in the overnight target rate led to the significant decrease of the prime rate, allowing Canadian business owners to obtain lower cost financing and consider refinancing existing debt at lower rates. After the BoC announced the first emergency rate cut of 50bps on March 4, the prime rate subsequently dropped from 3.45% to 2.95%. Similarly, after the March 16 overnight rate cut, the prime rate decreased to 2.45% and is forecast to remain at this level into the beginning of 2022.

Canada’s inflation rate ranged from 1.6% to 2.3% during the three years ended 2019. Despite the contraction in the nation’s GDP in 2020, inflation is forecast to remain relatively flat over the next two years.

The CAD has traded between $0.76 and $0.77 USD between 2017 and 2019 before dropping significantly to $0.71 during Q1 2020. The CAD/USD is expected to drop further to $0.69 for Q2 2020 before slowly recovering to $0.71 by the end of 2020, with stronger recovery during 2021 to $0.74.

Capital Markets

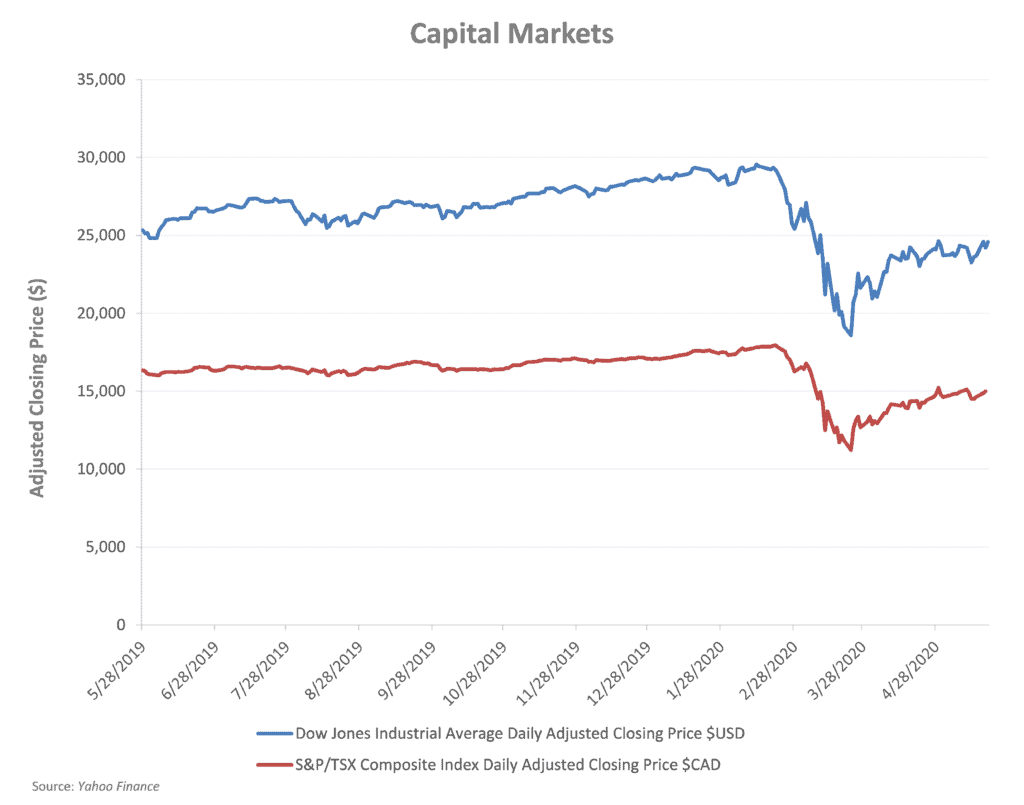

Typically, capital markets are forward thinking and tend to reflect the anticipated performance of the listed companies. The Dow Jones Industrial Average (DJIA) tracks the 30 largest companies from different industries in the US and is widely viewed as a general health indicator of the financial markets and even the US economy. The S&P/TSX Composite index[1] is the benchmark Canadian index and tracks the 250 largest companies trading on the Toronto Stock Exchange, which accounts for 70% of the exchange’s market capitalization.

The international response to Covid-19 at the beginning of March has negatively impacted the current and anticipated operations of many privately-owned and publicly traded North American businesses. For publicly traded companies this impact is evident in changes in capital markets during the period. During Q1 2020, the DJIA and S&P/TSX Composite index decreased by 23.2% and 21.6%, respectively. These drastic declines were the largest drops these indexes have experienced since October of 1987. Subsequent to Q1 2020, index prices have rallied somewhat, demonstrating the market’s measured confidence in economic recovery.

It will be difficult to know the full impact of Covid-19 on the Canadian, Provincial and regional economies. Current economic indicators are suggesting a slow return to pre-pandemic levels as Covid-19 protective measures begin to lift. Business owners will benefit from proactively managing resources to enable full participation in the anticipated market recovery.

[1] In 1977, the TSE 300 index was created, comprising of the 300 largest companies on the TSX. In 2002, Standard and Poor’s took responsibility of the index and renamed it the “S&P/TSX Composite Index”.