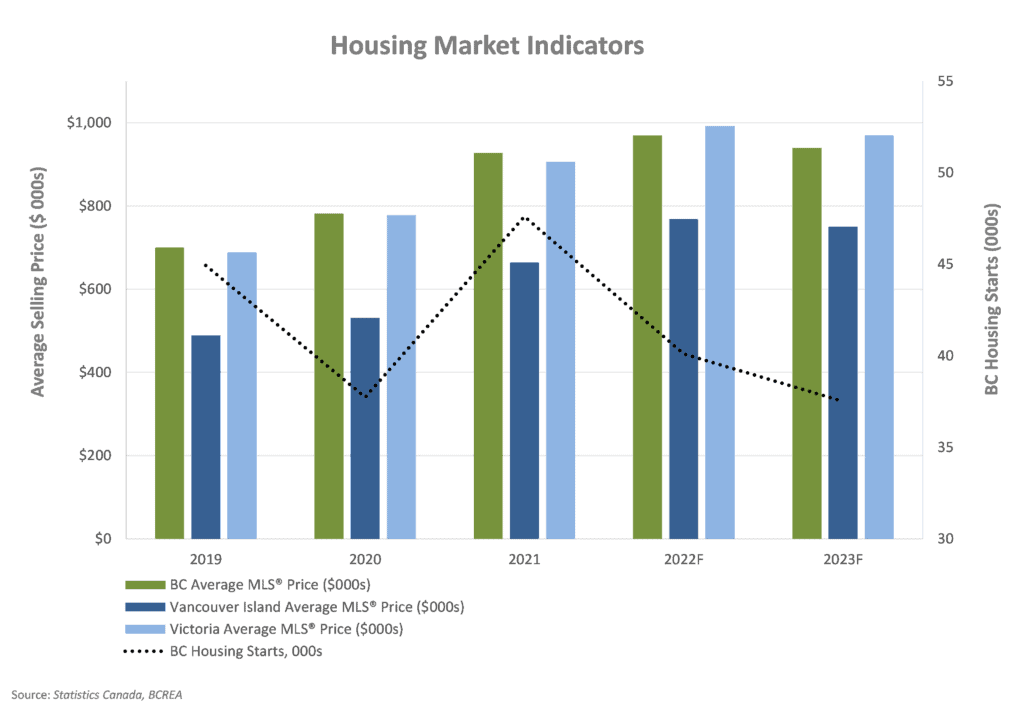

By the end of the prior quarter, the Canadian economy had fully returned to or exceeded the pre-pandemic levels of most major economic indicators.

By the end of the prior quarter, the Canadian economy had fully returned to or exceeded the pre-pandemic levels of most major economic indicators.

In Q3, the Bank of Canada increased the target overnight rate to cool increasing inflation resulting from post-lockdown consumer activity and excess savings. Higher interest rates and increased inflation are expected to result in longer-term economic stagnation. Over the short-term, TD Economics (TDE) forecasts Canada’s GDP to grow at average 3.0% for 2022, a small decline from their Q2 forecast of 3.3%.

BC’s economy is expected to mirror the country’s, with growth fuelled by elevated coal and natural gas prices and tourism. TDE’s current forecast for BC’s 2022 GDP growth is 3.1%, a decline from the prior quarter’s forecast of 3.6%. TDE attributes the reduced GDP growth to rising interest rates and downgraded growth forecasts for the US and China (BC’s primary international export markets). In BC real estate comprises a disproportionate share of household wealth, so household spending might be particularly sensitive to any recalibrating of home prices.

This post provides an update from Q2 2022 to Q3 2022 for selected economic indicators. The indicators discussed herein are both indicative and representative of the Canadian, BC, and regional economies.

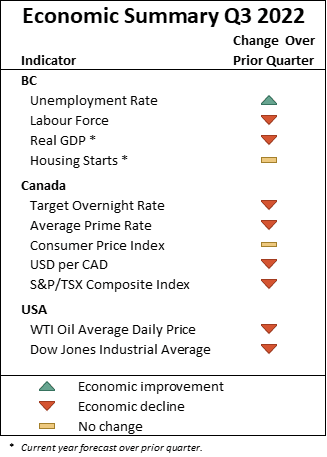

Labour Market

The labour force refers to the supply (employees) and demand (employers) for labour. The number of labour force participants and the unemployment rate are indicators that highlight the material changes that took place in the labour market from Q2 2022 to Q3 2022.

COVID-19 Government Programs

The federal government initiated several programs to support employers and employees impacted by COVID-19. Currently, the Jobs and Growth Fund is available for employers. On September 25, BC lifted the temporary changes to the Work-Sharing Program made in response to COVID-19. Whereas before September 24 Work-Sharing agreements could last a maximum of 38 weeks with a possible extension to 78 weeks, agreements now can last between 6-26 weeks, with a possible extension to 38 weeks.

National

Before the impact of COVID-19, Canada experienced a steady increase in labour force participants. As of September 30, 2022, the Canadian labour force consisted of 20.6 million people. Although this level is a decrease of approximately 345,000 participants since the prior quarter, it is still above the pre-COVID level of 20.0 million.

The national unemployment rate was 4.7% at the start of Q3 (and finished the quarter at the same rate) which was 1.2% lower than the pre-pandemic rate of 5.9%. Nevertheless, TDE forecasts an increase in Canada’s unemployment rate over the remainder of 2022 and the longer term.

BC

During Q3, BC’s unemployment rate decreased from 4.5% to end the quarter at 3.9%, which is 1.1% lower than the province’s pre-COVID rate of 5.0%. TDE forecasts BC’s unemployment rate to increase to 5.0% by the end of 2022, which is up from their Q2 forecast of 4.8%, due to a reduction in retail spending.

Regional

The unemployment rate for Vancouver Island and Coastal regions increased during Q3 from 4.0% to 4.3%, which is 1.0% lower than pre-pandemic rates. In Victoria, the unemployment rate increased throughout the quarter from 4.1% to 4.8%, as the region has not yet seen a return to its pre-pandemic unemployment rate of 3.5%.

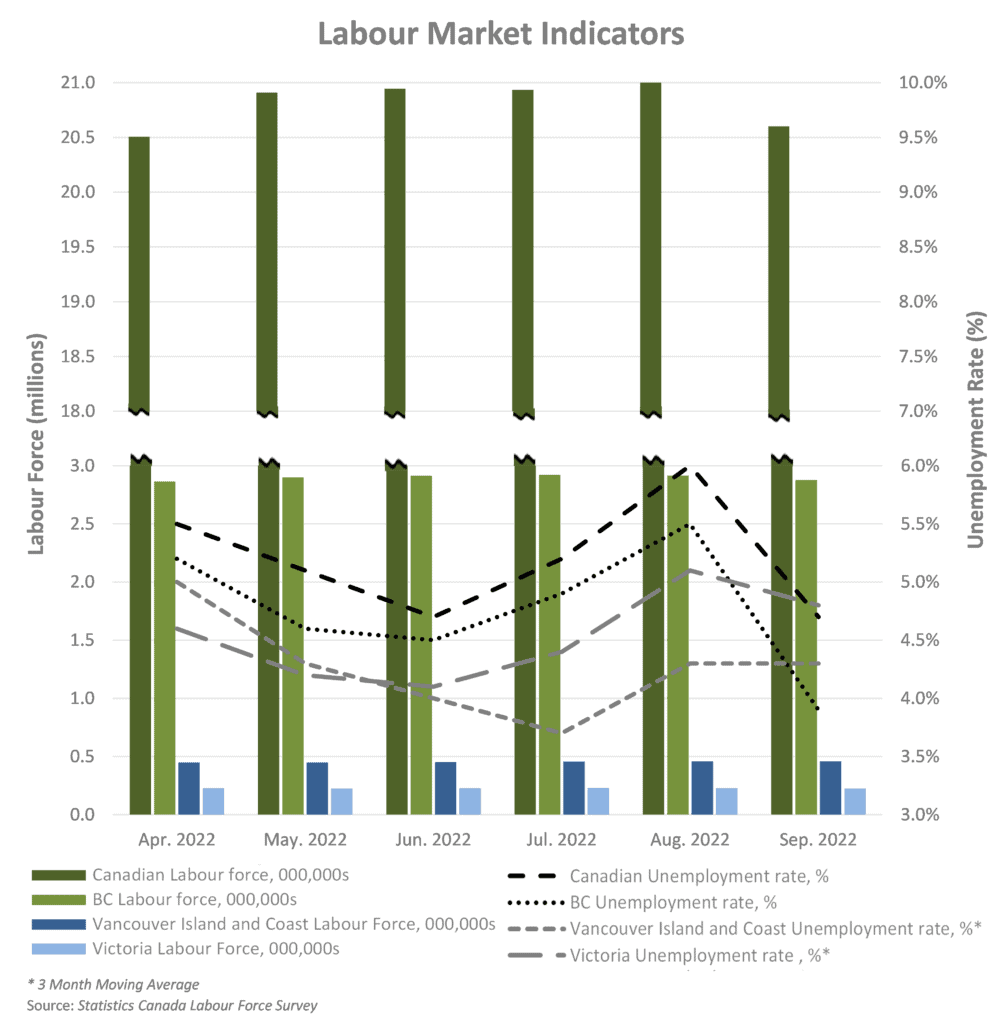

Gross Domestic Product (GDP)

National

TDE forecasts Canada’s real GDP for 2022 to grow by 3.3% for Q3, which is 0.4% lower than their forecast mid-way through the year. TDE attributes this growth to increased spending that resulted from the lifting of COVID-related restrictions in Canada. TDE forecasts a further slowing of the national GDP growth rate to 0.9% for 2023.

BC

TDE also forecast slower growth for the BC economy of 3.1% for 2022 which is 0.5% lower than the forecast from the previous quarter (Q2 2022). The resulting forecast for BC’s GDP is $270.3 billion, $8.1 billion higher than 2021 and $14.6 billion above 2019’s pre-pandemic levels. TDE attributes their downgraded forecast to rising interest rates, slower growth in the US and China, and the possibility of household spending being impacted by any re-calibration of home prices.

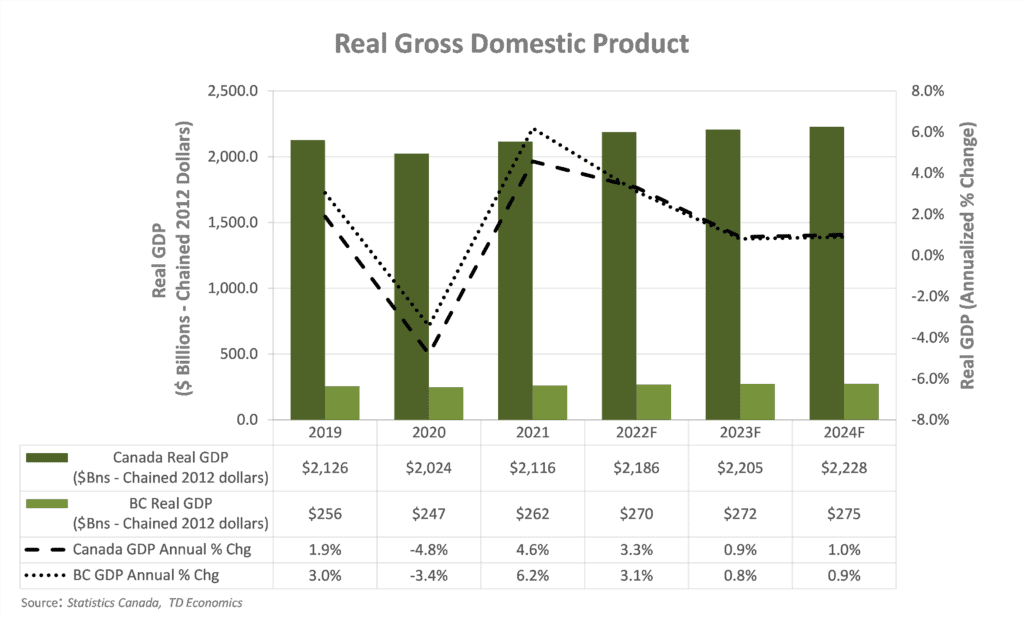

Housing Market

BC

Housing starts and average residential prices reflect market indicators with strong correlation to both the construction and real estate industries. BC’s housing starts increased by 26.2% during 2021, reversing months of consecutive declines. The BC Real Estate Association (BCREA) forecasts a decrease in housing starts of 15.8% for 2022 followed by another decrease of 6.5% for 2023, due mainly to the impact of recent interest rate increases on housing demand.

BC’s housing starts increased by 26.2% during 2021, reversing months of consecutive declines. The BC Real Estate Association (BCREA) expects housing starts to moderate following years of robust new residential construction. BCREA forecasts a decrease in housing starts of 15.8% for 2022 followed by a further decrease of 2.7% for 2023 mainly due to the impact of recent interest rate increases on housing demand.

BCREA forecasts an increase of 4.5% in the BC average MLS® price for single family dwellings for 2022, resulting in an average price of $969,000 for the year, which is a downgrade from BCREA’s Q2 forecast (11.5% increase). BCREA expects unit sales to slow down by the end of 2022, due to the current high levels of inflation.

BCREA has also downgraded their average MLS® price growth forecast for 2023 from an increase of 0.8% to a decrease of 3.1%, resulting in a lower average price of $939,500 next year.

Regional

BCREA forecasts an increase in average MLS® prices for single family dwellings on Vancouver Island of 15.7% for 2022, and a decrease of -2.4% for 2023. In Victoria, BCREA forecasts an increase in the average MLS® prices for single family dwellings of 9.5% for 2022, and a decrease of 2.2% for 2023. Their Q3 forecasts are likewise downgrades from prior quarter predictions.

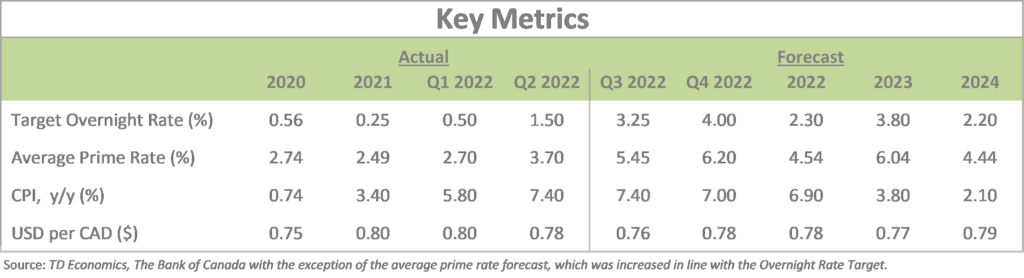

Interest Rates & Foreign Exchange

During Q3 2022, the Bank of Canada (BoC) significantly increased the overnight target rate from last quarter’s 1.50% to 3.25%by the end of Q3. TDE forecasts that the target rate will continue to rise to 4.00% by the end of 2022. TDE then expects the target rate to average 3.80% for 2023 before decreasing to average 2.20% for 2024.

The rising overnight target rate resulted in an increase in the prime rate. The average prime rate for Q3 was 5.45%, which an increase of 175 basis points from the prior quarter. The prime rate is likely to continue increasing in step with the target overnight rate.

The BoC has stated that it will continue to increase policy rates in an effort to return the inflation rate to the long-term target of 2.00% from its recent high of 7.4% for Q2 2022. The BoC expects there to be some lag in the process and TDE forecasts inflation to be 6.9% for 2022 before decreasing to 3.8% for 2023. TDE attributes inflation increases in Canada to Russia’s invasion of Ukraine, COVID-19 related lockdowns in China, and other supply disruptions.

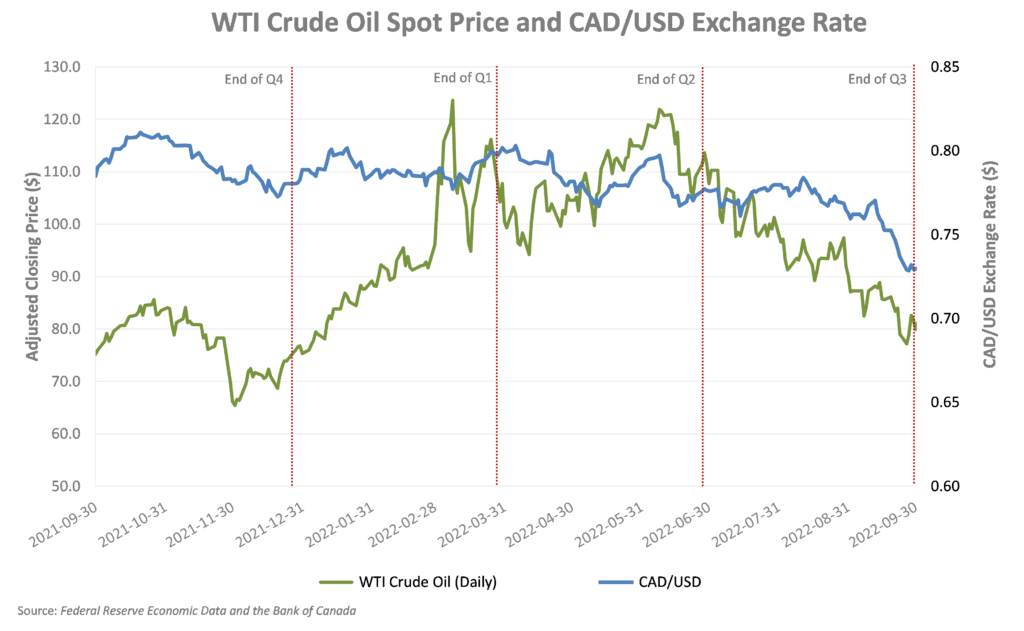

The Q3 2022 forecast for the average annual USD to CAD exchange rate was $0.78 for 2022. with expectations for it to remain relatively constant at $0.77 for 2023 and $0.79 for 2024. This exchange rate tends to correlate to oil prices, and over the long-term the value of the Canadian dollar relative to the US dollar typically fluctuates in-step with oil price changes.

Crude Oil Prices

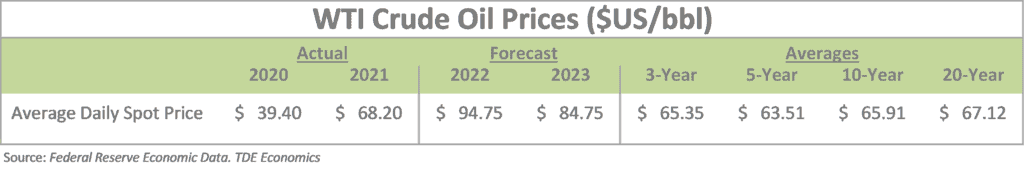

Canada has the fourth largest proven oil reserves in the world. As a net oil exporter, the Canadian economy is heavily impacted by the price of crude oil, with the greatest impact felt in Canada’s major oil producing provinces. The majority of Canadian crude oil production is in Alberta (81.0%), Saskatchewan (10.0%), and Newfoundland and Labrador (6.0%).

In North America, the West Texas Intermediate (WTI) crude oil spot price is the benchmark oil price. Historical WTI crude oil daily spot prices at the end of Q3 were:

Over the course of Q3, WTI oil prices decreased from $110.3 on July 1 to $77.17 on September 26. The International Energy Agency (IEA) attributes the decrease to rising oil supplies and worsening economic prospects. TDE forecasts the WTI crude oil price to average $94.75 per barrel for 2022 before decreasing to $84.75 for 2023.

Capital Markets

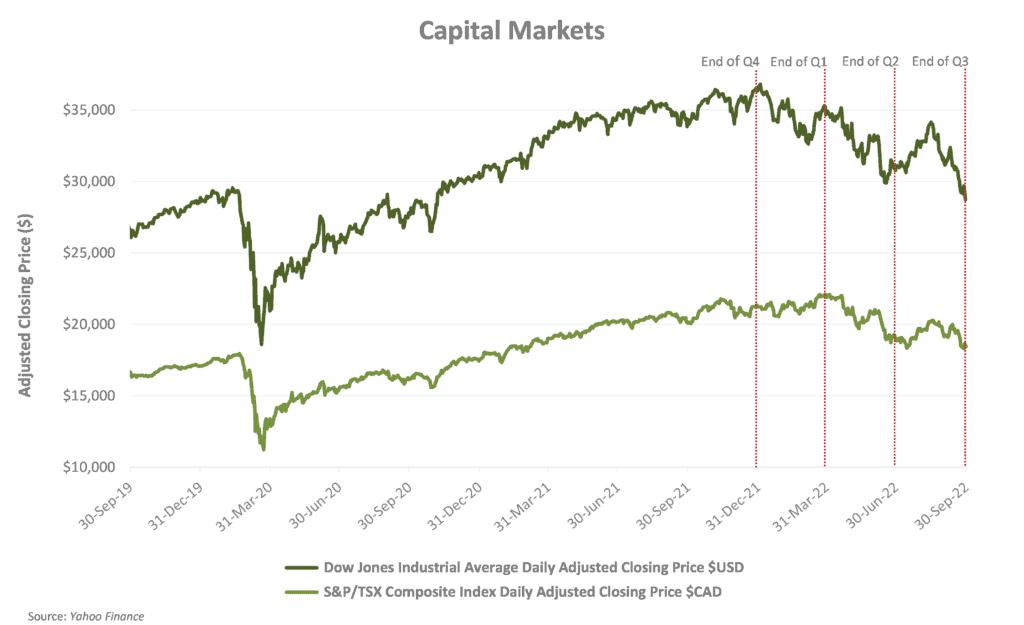

The international response to COVID-19 at the beginning of March 2020 negatively impacted the current and anticipated operations of many privately-owned and publicly traded North American businesses. For publicly traded companies, this impact is evident in changes in capital markets during the period.

Three successive crashes occurred, Black Monday I on March 9,2020, Black Thursday on March 12, 2020, and Black Monday II on March 16, 2020. On Black Monday II the Dow Jones Industrial Average (DJIA) and Black Thursday the S&P/TSX Composite Index witnessed the greatest single-day percentage drop since the stock market crashes of 1943 and 1987, respectively. Both indices continued to decline to March 23, 2020 when they reached record lows. By the start of 2021 both indices had recovered to their pre-COVID-19 levels.

More recently, both the DJIA and S&P/TSX Composite indices reached all-time highs in Q1 2022: $36,800 (USD) on January 4, 2022, and $22,087 (CAD) on March 29, 2022, respectively. In Q3 these indices dipped, with the DJIA index reaching a quarter high of $34,152 (USD) on August 16 and the S&P/TSX index reaching a quarter high of $20,270 (CAD) also on August 16, before trending downward to Q3 lows of $28,726 (USD) and $18,308 (CAD) for the DJIA and S&P/TSX indices, respectively, near the end of the quarter.

The year-to-date loss for both indices were -13.1% and -21.5%, respectively, reversing over a year of growth. It is important to note that these indicators are based on forward looking assumptions and analysis.

Moving into the fourth quarter of 2022, inflation is expected to continue at its currently elevated rate due to continued supply constraints, the impact of the Ukraine war, and high labour costs from continued above-average job vacancy rates. The BoC is expected to continue to maintain current interest rates into the next quarter to combat high inflation. As a result, economic growth is forecast to continue slowing down in both the US and Canada. TDE does not anticipate a recession but notes that growth will come close to stalling. Moving into 2023 TDE forecasts that the CPI will return to slightly lower levels due to more stagnant economic growth, the easing of supply chain disruptions, and lower energy prices.

Some businesses may still be able to benefit from the fiscal stimulus provided by various levels of government, but higher input prices and labour costs are expected to stifle profit margins in many industries. However, energy, commodity, and food producing sectors could stand to benefit from higher prices. Interest rates are expected to hold steady, maintaining downward pressure on housing prices.

A glossary of all defined terms can be found here.

[1] In 1977, the TSE 300 index was created, comprising of the 300 largest companies on the TSX. In 2002, Standard and Poor’s took responsibility of the index and renamed it the “S&P/TSX Composite Index”.