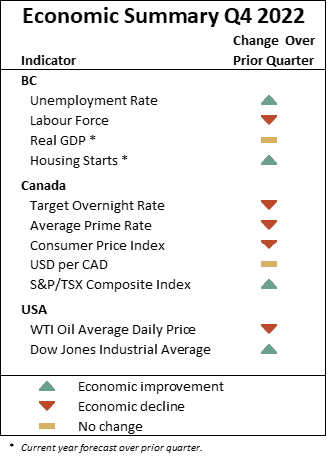

By the end of Q2 2022, the Canadian economy had returned to or exceeded the pre-pandemic levels of most major economic indicators.

By the end of Q2 2022, the Canadian economy had returned to or exceeded the pre-pandemic levels of most major economic indicators.

In Q3 and Q4, the Bank of Canada increased the target overnight rate to dampen rising inflation resulting from post-lockdown consumer activity and excess savings. Higher interest rates and increased inflation are expected to result in longer-term economic stagnation. Over the short-term, TD Economics (TDE) forecasts Canada’s GDP to grow at 3.5% for 2022, slightly more optimistic than their Q3 forecast of 3.3%.

BC’s economy is expected to decrease due to a cooling housing market. In BC, real estate comprises a disproportionate share of household wealth, and so discretionary household spending is sensitive to possible downward recalibration of home prices. TDE’s current forecast for BC’s 2022 GDP growth is 3.1%, which remains unchanged from their Q3 forecast, due to offsetting factors arising from the real estate market and continued high natural gas prices.

This post provides an update from Q3 2022 to Q4 2022 for selected economic indicators. The indicators discussed herein are both indicative and representative of the Canadian, BC, and regional economies.

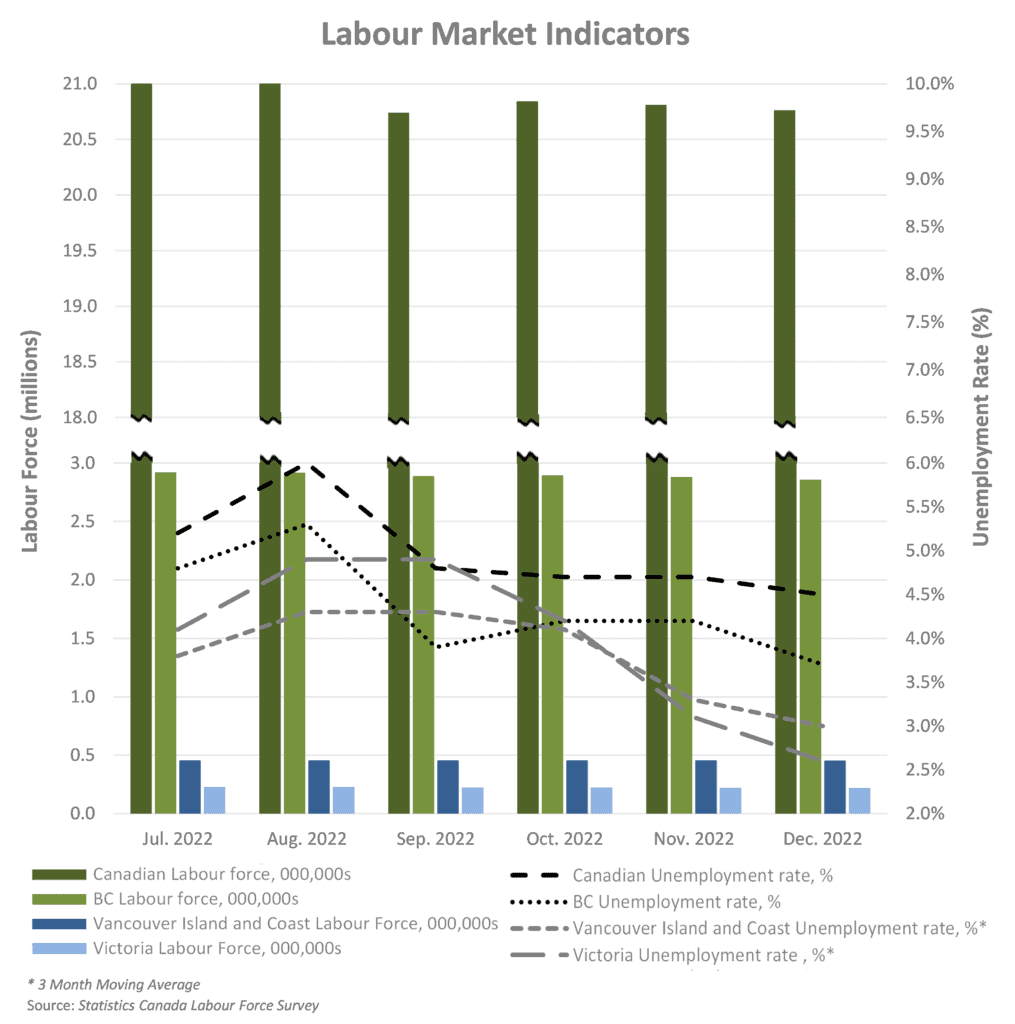

Labour Market

The labour force refers to the supply (employees) and demand (employers) for labour. The number of labour force participants and the unemployment rate are indicators that highlight the material changes that took place in the labour market from Q3 2022 to Q4 2022.

COVID-19 Government Programs

The federal government initiated several programs to support employers and employees impacted by COVID-19. Currently, these COVID-19 specific programs are no longer in effect; however, the Jobs and Growth Fund no longer has COVID-19 stipulations but is available to support regional job creation in companies that meet the criteria.

National

Before the impact of COVID-19, Canada experienced a steady increase in labour force participants. As of December 31, 2022, the Canadian labour force consisted of 20.8 million people. This level is a decrease of approximately 21,000 participants since the prior quarter and above the pre-COVID level of 20.0 million.

The national unemployment rate was 4.8% at the start of Q4 and finished the quarter at 4.5% which was 1.4% lower than the pre-pandemic rate of 5.9%. Nevertheless, TDE forecasts an incremental increase in Canada’s unemployment rate over both the near and long term.

BC

During Q4, BC’s unemployment rate decreased from 3.9% to 3.7%, which is 1.3% lower than the province’s pre-COVID rate of 5.0%. TDE forecasts BC’s average unemployment rate for 2022 to be at 4.7%, which is down from their Q3 forecast of 5.0%.

Regional

The unemployment rate for Vancouver Island and Coastal regions decreased during Q4 from 4.3% to 3.0%, which is 2.3% lower than pre-pandemic rates. In Victoria, the unemployment rate decreased throughout the quarter from 4.9% to 2.6%, marking the first quarter that the region fell below its pre-pandemic unemployment rate of 3.5%.

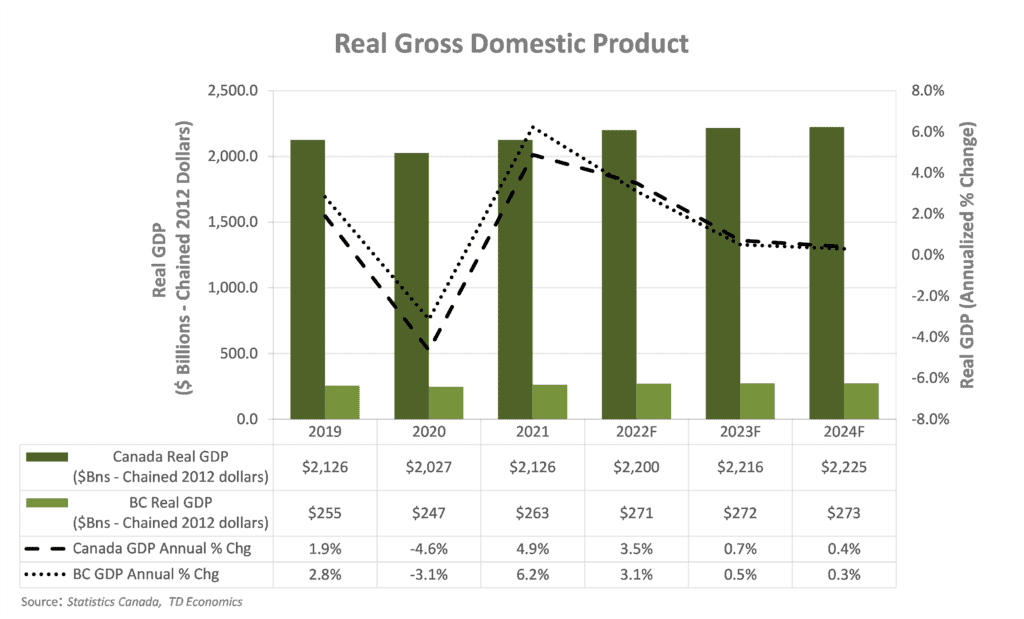

Gross Domestic Product (GDP)

National

TDE forecasts Canada’s real GDP for 2022 to grow by 3.5% during Q4, which is just slightly higher than their Q3 forecast of 3.3%. This growth is attributed to increased employment in the quarter. TDE forecasts a slowing of the national GDP growth rate to 0.7% for 2023 due to the impact of increasing inflation and interest rates.

BC

TDE also forecast growth for the BC economy of 3.1% for 2022, remaining consistent with their Q3 forecast. TDE attributes this forecast to offsetting factors arising from sales declines in the housing market, and the surge in natural gas production while high prices continue.

The resulting forecast for BC’s GDP is $270.7 billion, $8.1 billion higher than 2021 and $15.6 billion above 2019’s pre-pandemic levels. TDE forecast GDP to grow at 0.5% for 2023 which is slightly below the nation’s forecast but also due to rising inflation and interest rates.

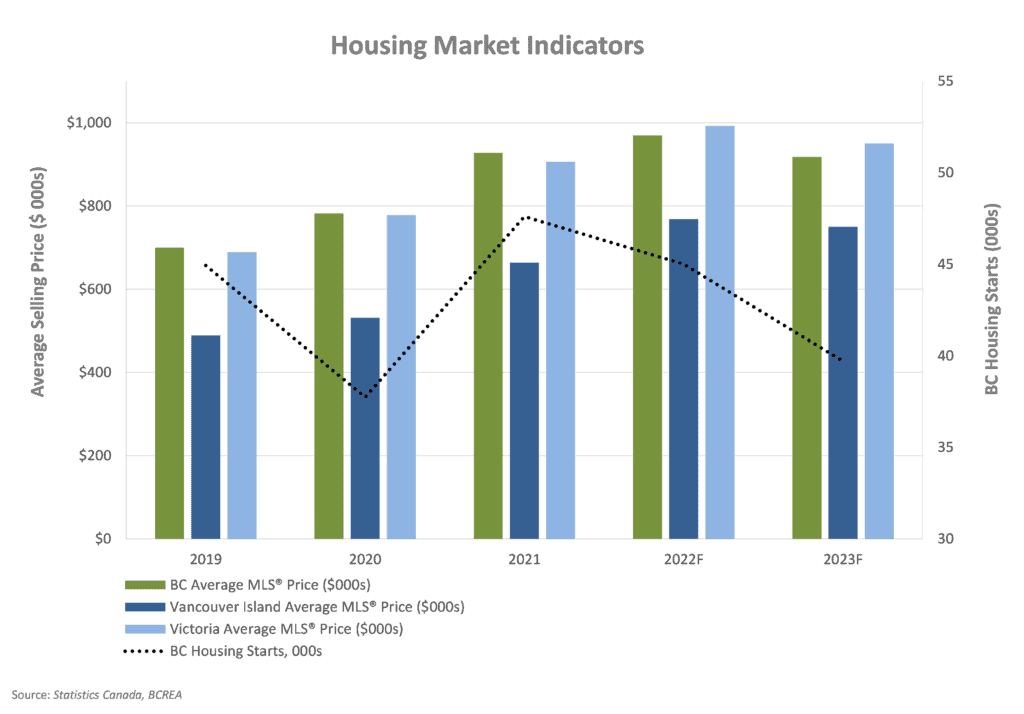

Housing Market

BC

Housing starts and average residential prices reflect market indicators with a strong correlation to both the construction and real estate industries. BC’s housing starts increased by 26.2% during 2021, reversing months of consecutive declines. The BC Real Estate Association (BCREA) forecasts a decrease in housing starts of 5.5% for 2022 followed by another decrease of 11.8% for 2023, due mainly to the impact of recent interest rate increases.

BCREA forecasts an increase of 4.6% in the BC average MLS® price for single family dwellings for 2022, resulting in an average price of $970,000 for the year, which is a slight increase from BCREA’s Q3 forecast of 4.5%. BCREA expects unit sales to slow down toward the end of 2022, due to increasing interest rates.

BCREA has also downgraded their average MLS® price growth forecast for 2023 from a decrease of 3.1% to a decrease of 5.4%, resulting in a lower average price of $918,000 predicted for next year.

Regional

BCREA forecasts an increase in average MLS® prices for single family dwellings on Vancouver Island of 15.7% for 2022, with a decrease of 2.4% predicted for 2023. In Victoria, BCREA forecasts an increase in the average MLS® prices for single family dwellings of 9.5% for 2022, and a decrease of 4.3% predicted or 2023. The trend in BCREA’s forecasts for Vancouver Island and Victoria are consistent with the prior quarter.

Interest Rates & Foreign Exchange

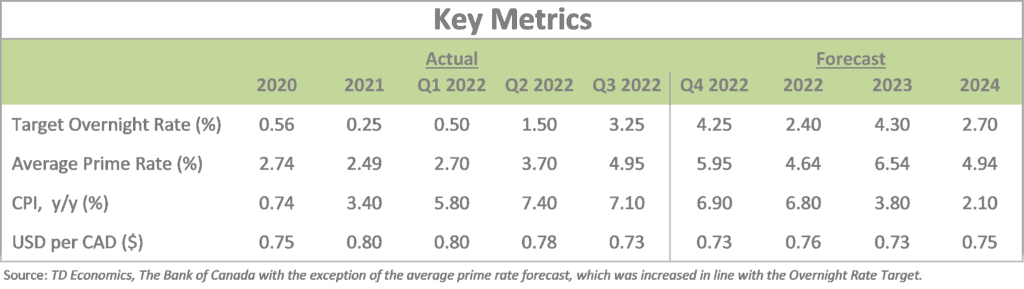

During Q4 2022, the Bank of Canada (BoC) significantly increased the overnight target rate from last quarter’s 3.25% to 4.25% by the end of Q4. TDE forecasts that the target rate will peak at 4.50% during Q1 of 2023, and expects the target rate to average 4.30% for 2023 before decreasing to average 2.70% for 2024.

The rising overnight target rate resulted in an increase in the prime rate. The average prime rate for Q4 was 5.95%, which is an increase of 1.00% from the prior quarter. The prime rate is likely to continue increasing in step with the target overnight rate.

The BoC has stated that it will continue to increase policy rates in an effort to return the inflation rate to the long term target of 2.00% from its recent high of 7.40% for Q2 2022. Naturally, there is expected to be some lag in the process and TDE forecasts inflation to be 6.80% for 2022 before decreasing to 3.80% for 2023. The BoC attributes Canada’s inflation increases to strong demand for services, which is exacerbated by labour shortages, in response to the reopening of the economy after the pandemic, with increases in demand for goods, which are exacerbated by supply chain constraints, particularly from goods supplied from China.

TDE forecasts the average annual USD to CAD exchange rate at $0.76 for 2022, $0.73 for 2023, and $0.75 for 2024, indicating a weaker CAD for 2023. This exchange rate tends to correlate to oil prices, and over the long-term the value of the Canadian dollar relative to the US dollar typically fluctuates in-step with oil price changes.

Crude Oil Prices

Canada has the fourth largest proven oil reserves in the world. As a net oil exporter, the Canadian economy is heavily affected by the price of crude oil, with the greatest impact felt in Canada’s major oil producing provinces. The majority of Canadian crude oil production is in Alberta (81.0%), Saskatchewan (10.0%), and Newfoundland and Labrador (6.0%).

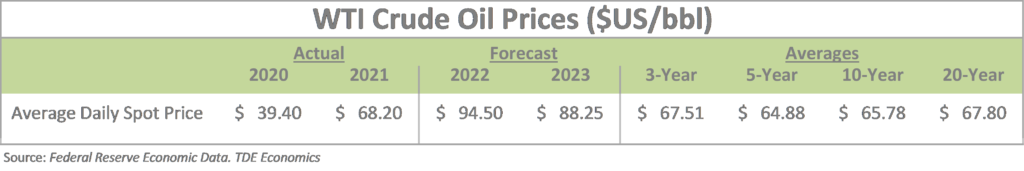

In North America, the West Texas Intermediate (WTI) crude oil spot price is the benchmark oil price. Historical WTI crude oil daily spot prices at the end of Q4 were:

Over the course of Q4, WTI oil prices decreased from $84.05 on October 3, 2022 to $80.16 on December 30, 2022. The International Energy Agency (IEA) attributes the decrease to rising oil supplies and worsening economic prospects. TDE forecasts the WTI crude oil price to average $94.75 per barrel for 2022 before decreasing to $84.75 for 2023.

Capital Markets

The international response to COVID-19 at the beginning of March 2020 negatively impacted the current and anticipated operations of many privately-owned and publicly traded North American businesses. The Dow Jones Industrial Average (DJIA) and S&P/TSX Composite Index witnessed the greatest single-day percentage drop since the stock market crashes of 1943 and 1987, respectively.

By the start of 2021 both indices had recovered to their pre-COVID-19 levels and in the first quarter of 2022 both indices reached all-time highs. In Q4, these indices increased from the lows at the start of the quarter to highs of $34,590 (USD) on November 30, 2022 and $20,526 (CAD) on December 1, 2022 for the DJIA index and the S&P/TSX, respectively.

After these highs both indices decreased in value to the end of the quarter, but finished higher than they began. Nevertheless, the year-to-date loss for both indices were -8.8% and -8.7%, respectively. It is important to note that these indicators are based on forward looking assumptions and analysis.

Moving into the first quarter of 2023, inflation is expected to continue at its currently elevated rate due to continued labour and goods supply constraints, the impact of the Ukraine war, and high labour costs from sustained high job vacancy rates. The BoC is expected to continue to maintain current interest rates into the next quarter to combat high inflation. As a result, economic growth is forecast to continue slowing for 2023 in both the US and Canada and move towards stalling through 2024. TDE forecasts that the consumer price index will return to slightly lower levels in 2023 and reach the BoC target of 2.0% in 2024 due to stagnant economic growth, the easing of supply chain disruptions, and lower energy prices.

Higher input prices and labour costs are expected to stifle profit margins in many industries. However, energy, commodity, and food producing sectors could stand to benefit from higher prices. Interest rates are expected to hold steady, maintaining downward pressure on housing prices.